Feb 19, 2019

Enter the ‘Twilight Zone’ as Stock Nightmares Meet Credit Dreams

, Bloomberg News

(Bloomberg) -- By one measure, it’s been decades since stock traders were willing to pay so much for the strongest companies out there -- just as credit investors rush to the weakest balance sheets.

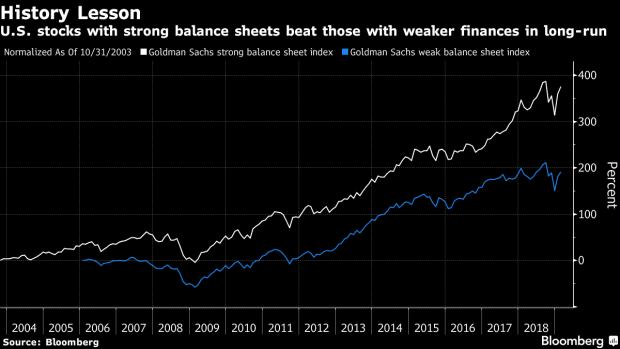

U.S. firms with solid financials now trade close to the highest valuation relative to their fragile peers since the dot-com era of 2003, according to Goldman Sachs Group Inc. indexes.

Juxtaposed against falling premiums on speculative-grade bonds to power the best start to a year since 2009, it suggests beneath the surface of the S&P rally that equity and debt investors are placing opposing bets on the business cycle.

How long the divergence can last is anyone’s guess. But one thing’s for sure: There are no shortage of Wall Street voices touting quality stocks to buffer portfolios from a market meltdown, including the likes of JPMorgan Asset Management and Northern Trust Asset Management.

At Kempen Capital Management NV, Roelof Salomons is riding both sides of these seemingly helter-skelter markets. He’s holding onto stronger equities while bidding up high-yield debt in a tactical bet on Goldilocks.

“We’re in this twilight zone of low growth, low inflation and low rates,” he said. “This benefits companies that have long duration because bonds aren’t moving anywhere. Growth won’t slow to the extent that we’ll have a recession but it’ll be slow. In this scenario, you want to own defensive equities.”

Safe Space

Sure, dovish monetary projections, benign technicals and low defaults can justify the rush for junk credit in concert with defensive wagers in stocks and Treasuries. But something has to give within the next six months at the latest, reckons Salomons. Either rates go up or growth craters, hitting levered assets along the way, according to the Amsterdam-based investor.

For now, the hunt for safety in equities goes on. Bank of America’s February fund manager survey shows angst over corporate debt is the highest since 2009. Traders have sunk some $1.85 billion into the iShares Edge MSCI USA Quality Factor ETF this year.

“Investors place higher scrutiny on leverage as we approach the end of the cycle and companies with stronger balance sheets are often preferred even if they are more expensive,” said Vincent Juvyns, a global market strategist at JPMorgan Asset Management.

Don’t get the wrong impression, levered companies have rebounded from the market hellfire in December, and continue to find a bid. It’s just investors keep on pumping up quality equities on the belief that stable earnings and lower debt will reduce the volatility of their portfolios, and help them outperform in any economic downturn.

That’s raising an uncomfortable question: Are they worth it?

The premium between global quality and value stocks is jumping back to multi-year highs. U.S. equities with strong balance sheets trade at about 25 times forward estimated earnings, compared with 12.5 times for those with weaker financial profiles, Goldman Sachs indexes show. The kind of valuation gap sits in the 94th percentile based on data going back to 1980, the bank said in a note this month.

All that combined with firmer risk appetite spurred Goldman strategists to reverse their two-year overweight recommendation on strong balance sheets earlier this month.

Hunker Down

At Legal & General Investment, Andrzej Pioch is staying neutral on quality firms, a factor with a wide range of definitions from low debt to strong earnings prospects. The money manager at the $1.3 trillion firm is sanguine on valuations, particularly on cash flows and book value, but market sentiment makes him “uncomfortable.”

Surveys Pioch cites suggest investors haven’t been this optimistic about the factor since late 2015, when deflationary fears stalked the world economy.

In other words, more money managers are becoming price-agnostic in their rush to hedge.

“I think it’s less about projecting where the market is going and what’s going to be the big winner, and more about building resilience into a portfolio in an event of a potential downturn,” said Holly Framsted, head of U.S. factor ETFs at BlackRock.

Michael Hunstad of Northern Trust Asset Management is playing defense. He’s helping to screen the fund’s $1.1 trillion of assets overall for equities that offer balance-sheet strength as well as asset turnover, a measure of corporate efficiency.

“It’s a good idea to buy high-quality stocks,” the head of quantitative strategies said. “I wouldn’t put all my chips on strong balance sheet. That’s why you need a collection of indicators to make sure you aren’t buying something that’s significantly gone up in price."

The good news is that quality stocks have traded at richer levels in absolute terms.

In Europe especially, there are plenty of reasonably valued shares with robust financial profiles in industrials, luxury goods, consumer discretionary and healthcare sectors, according to Bank of America. The MSCI Europe Quality Index is trading at 17.1 times forward earnings, compared to about 18.5 times for the S&P 500 Quality Index.

“Avoiding companies with strong balance sheets is a high-risk strategy, given the recession risk is still around,” said Olivia Engel, the chief investment officer for active quantitative equities at State Street Global Advisors. All the same, investors “shouldn’t pile into safety at any price. Balance is key,” she said.

--With assistance from Dani Burger and Luke Kawa.

To contact the reporter on this story: Ksenia Galouchko in London at kgalouchko1@bloomberg.net

To contact the editors responsible for this story: Blaise Robinson at brobinson58@bloomberg.net, Sid Verma, Samuel Potter

©2019 Bloomberg L.P.