May 27, 2022

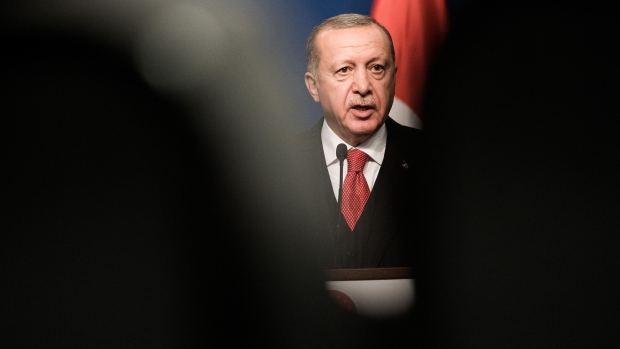

Erdogan Says Only Traitors or Illiterates Link Rate to Inflation

, Bloomberg News

(Bloomberg) -- President Recep Tayyip Erdogan spoke up against higher interest rates as a remedy for inflation a day after Turkey’s central bank opted to carry on with its ultra-loose approach, even as pressure builds on consumer prices and the lira.

“Those who try to impose on us a link between the benchmark rate and inflation are either illiterates or traitors,” Erdogan said on Friday in Istanbul, addressing a group of businesspeople. “Don’t pay attention to the ramblings of those whose only quality is in viewing the world from London or New York.”

Erdogan has frequently blamed what he used to call an “interest-rate lobby” for driving up the cost of borrowing and engaging in speculative attacks against the currency. Before installing Sahap Kavcioglu as governor of the central bank last year, Erdogan ousted his three predecessors and increasingly sought more say over monetary policy.

Still, the president acknowledged that the economic policies his government has followed since 2018 have exacted a “heavy toll” in the form of a higher cost of living for citizens. At 70%, Turkey’s annual inflation is currently 14 times higher than the central bank’s official target.

Turkey Keeps Rates Unchanged Despite Lira, Inflation Risks

Erdogan has nevertheless defied orthodox economic views, insisting that high rates are the cause of faster inflation, not the opposite. The central bank kept its benchmark at 14% for a fifth month on Thursday, leaving Turkey with the world’s deepest negative rates when adjusted for prices.

The Turkish lira has weakened 8.4% against the dollar in May, making it the worst performer among emerging-market currencies. Inflation is expected to accelerate past 74% in May, according to the median estimate in a Bloomberg survey of 15 analysts. The statistics office will publish the data on June 3.

Whatever the cost, Erdogan defended his government’s economic program as “consistent and scientific” and said the lira’s current level helps preserve Turkey’s competitiveness.

“All of us are in the same ship,” he told the audience on Friday. “There’s enough data to spur hope. We are doing well on production, employment and exports.”

©2022 Bloomberg L.P.