Nov 15, 2017

Eric Nuttall's Top Picks: November 15, 2017

BNN Bloomberg

Eric Nuttall, partner and senior portfolio manager at Ninepoint Partners

FOCUS: Energy stocks

_______________________________________________________________

MARKET OUTLOOK

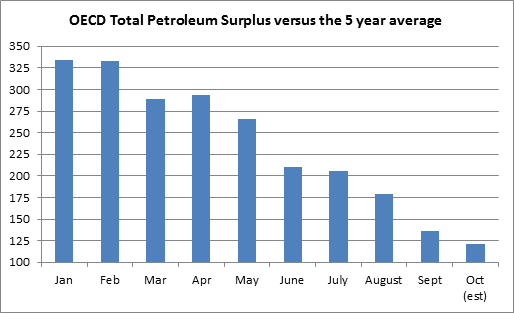

The oil market has measurably improved YTD in terms of both fundamentals and sentiment. The “oil glut” has fallen by 60 per cent in the first 10 months of the year and this trend will continue given strong demand growth, high OPEC compliance to its production cut, anemic non-U.S./OPEC supply growth, and a moderation in U.S. production growth rates. We still believe the oil market can reach normal levels by early 2018. The oil price has made a two year high given this backdrop and our earlier prediction of oil rallying into the mid-US$50’s by year end has come to pass. There remains a massive, giant, epically humongous divergence between the price of oil and the price of oil stocks due to tax loss selling, worries about oil demand destruction due to electric car adoption, lack of sector rotation, and uncertainty heading into the November 30th OPEC meeting.

With valuations in some cases at roughly half of historical levels, we see extremely attractive upside in energy stocks. Perhaps it will just take getting past tax loss selling season and the November 30th OPEC meeting for investors to return to the space. In the meantime, our holdings continue to experience record profitability levels, announce massive share buybacks, and reduce overall leverage due to high levels of free cash flow. We remain in a multi-year bull market for oil… patience will eventually pay off.

For more information, visit www.ninepoint.com/media/318873/sprott-energy-fund-monthly-commentary.pdf

TOP PICKS

TRICAN WELL SERVICE (TCW.TO)

Trican Well Service is a Canadian pressure pumper that is benefiting from an undersupplied market that is resulting in strong price increases and multi-year high margins. The company reported outstanding Q3 results beating consensus by 27 per cent and offered a strong outlook for the next several quarters. While uncertainty around 2018 Canadian natural gas pricing and a possible retrenchment in dry natural gas spending has hurt the stock in recent days (along with a TD downgrade, which in our opinion has several significant flaws in logic), we believe the stock offers very compelling upside. With net cash on the balance sheet after accounting for their interest in FRAC.US, TCW trades at 3.8x our 2018 EBITDA estimate versus a more normalized multiple of 6-7x. Last purchased November 14th at $4.45.

SOURCE ENERGY SERVICES (SHLE.TO)

Source is the largest and dominant provider of frac sand in Canada. Given extremely strong demand growth for frac sand (leading edge well designs = 50 per cent plus potential increase in 2017 average), we believe 2018 and 2019 consensus EBITDA for the company is too low. Allowing for only modest price increases in 2018, we believe the company can generate $172M in EBITDA and$95M in free cash flow versus consensus of $142M. This would have the stock trading at 4.0x 2018 and around 3.3x 2019 EBITDA versus U.S. peers at 4.7x, despite better underlying market fundamentals and significantly higher barriers to entry offering 50 per cent upside over the next year. Last purchased November 15th at $9.42.

C&J ENERGY SERVICES (CJ.N)

C&J is a diversified U.S. oil and gas service company with a large weighting towards pressure pumping. We believe the U.S. will be short pressure pumping equipment for all of 2018 due to strong growth and a lack of excessive new build capacity. As well, given an oil price of aroudn US$55/bbl in 2018, they will be able to increase pricing on other service lines that have not yet had the same pricing tension as pressure pumping. The stock trades at 4.6x 2018 and 3.5x 2019 EBITDA, which represents a peak multiple when we think their earnings power is sustainable for the next several years. Last purchased September 26th at $30.45.

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| TCW | N | N | Y |

| SHLE | N | N | Y |

| CJ | N | N | Y |

PAST PICKS: OCTOBER 7, 2016

CARDINAL ENERGY (CJ.TO)

- Then: $9.07

- Now: $4.73

- Return: -47.85%

- Total return: -43.89%

CANYON SERVICES (FRC.TO) – delisted on June 7, 2017

- Then: $5.62

- June 7, 2017: $6.66

- Return: 18.50%

- Total return: 18.50%

BIRCHCLIFF ENERGY (BIR.TO)

- Then: $9.48

- Now: $5.11

- Return: -46.09%

- Total return: -45.46%

TOTAL RETURN AVERAGE: -23.61%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| CJ | Y | N | Y |

| FRC | N | N | N |

| BIR | N | Y | Y |

WEBSITE: www.ninepoint.com