Apr 22, 2021

ESG Demand Helps Fund Manager’s Stock Outpace Australian Peers

, Bloomberg News

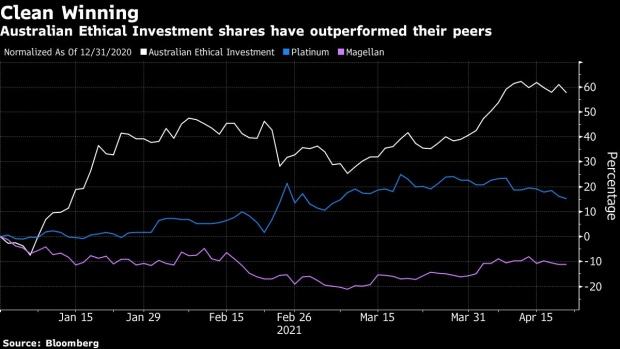

(Bloomberg) -- The stock performance of an Australian fund manager that’s focused on ethical investments is trouncing its peers as ESG assets soar in popularity.

Australian Ethical Investment Ltd.’s stock price has jumped 57% so far in 2021, outperforming shares of other Australian asset managers such as Magellan Financial Group Ltd. and Platinum Asset Management Ltd. While those firms consider ESG issues or have sustainable investment options, Australian Ethical’s emphasis on socially-minded companies may have given its stock an edge over its rivals.

The firm’s share outperformance “signifies the thriving landscape of Australia in ESG investing,” said Bloomberg Intelligence analyst Esther Tsang. Australian Ethical, “which may be considered as a pure player in ESG investing, is set to benefit from this strong ESG momentum.”

The demand for sustainable investments in Australia has been growing alongside a global ESG push. Assets under management of Australian ESG exchange-traded funds have grown by more than 50% on 2020 and have notched an average return that’s outperformed the nation’s benchmark stock index, according to Tsang.

Australian Ethical shuns sectors like tobacco and coal mining, and seeks out companies that contribute to priorities like sustainability and innovative technology, according to the firm’s website. It had stakes in companies including Tesla Inc., AT&T Inc. and Westpac Banking Corp. as of Dec. 31.

The stock’s rally comes as investment firms and banks are increasingly facing pressure to address ESG matters. Major Australian lenders Commonwealth Bank of Australia and Australia & New Zealand Banking Group Ltd. have both recently boosted the size of its sustainable divisions.

©2021 Bloomberg L.P.