Dec 9, 2022

ESG Investing’s Real Problem Is a Lack of Data, Fixed-Income Pros Say

, Bloomberg News

(Bloomberg) -- As the debate heats up over ESG investing, fixed-income professionals say they need more data than what’s currently out there.

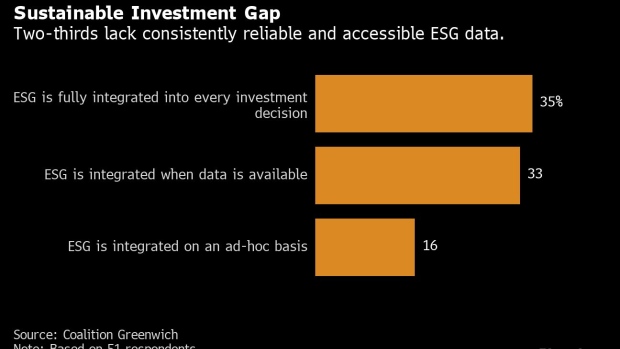

A survey of 111 senior buy-side fixed-income investors, conducted by analytics firm Coalition Greenwich, found that 90% believe the popular strategy, which prices in environmental, social and governance risks, is important to decision making. Yet only about a third of investors have fully integrated ESG into their risk-analysis. The reason? Not enough data.

“It boils down to risk-management,” said Coalition Greenwich’s senior analyst Stephen Bruel. “If you don’t have reliable ESG data about an issuer or issuance, then it’s harder to calculate what the negative consequences might be.”

The report’s findings come just as Republicans are escalating attacks against Wall Street’s ESG investment practices. States including Florida have pulled money from firms like BlackRock Inc., sustainable investing’s biggest champion. Tesla Inc. founder Elon Musk and former Vice President Mike Pence have also piled on with public attacks against ESG. Meanwhile, regulators are cracking down on the mislabeling of sustainability-linked funds and bonds, and some say the acronym should just be dropped altogether.

Even though ESG has morphed into a “woke” bogeyman for US conservatives, demand for sustainable investing continues to grow. Global ESG assets will exceed $40 trillion this year, and $50 trillion by 2025, according to Bloomberg Intelligence. The forecast suggests ESG is here to stay.

More than half of respondents to the survey said it was important to incorporate ESG in fixed-income portfolios to perpetuate corporate values, while another 35% flagged risk management as an appealing factor.

But there’s a gap between where survey participants want the industry to be and where it actually is, with data challenges named as the biggest obstacle to achieving ESG goals. Those include concerns about data quality, such as greenwashing and inconsistent ratings. If there’s a dearth of reliable ESG data, then quantifying risk becomes risky in and of itself, making it harder to follow the ESG boom – and opening investors up to considerable losses.

That’s to be expected to some degree given the nascent nature of the field, said Bruel. Once technology advances and regulations are finalized, they should help firms and their clients spot and measure risks and opportunities, but a whopping 49% of respondents said there’s still a ton of room for improvement.

“The tools need to improve to ensure investors who are interested in allocating their capital to ESG-friendly investments are able to form a complete picture of the issuer and issuance,” said Bruel.

Not all ESG investments are created equal, either. Calculating climate risk, for example, is a tricky area that would especially benefit from increased data. How will a hotter planet impact municipal-issued debt in areas of the country that are increasingly vulnerable to wildfires and hurricanes, for example?

“It’s OK if there’s climate risk on the issuer, as long as you can quantify that and incorporate that into the price,” said Bruel. “But that’s something that many have difficulty doing right now.”

In the near-term, more than half of survey respondents called on improved ESG reporting to stakeholders, while some 47% said ESG should be extended to the entire investment lifestyle.

©2022 Bloomberg L.P.