Jul 21, 2021

ESG-Related Assets in U.S. Now Exceed the European Market

, Bloomberg News

(Bloomberg) -- The U.S. market for ESG assets has jumped ahead of Europe in a sharp break from the past.

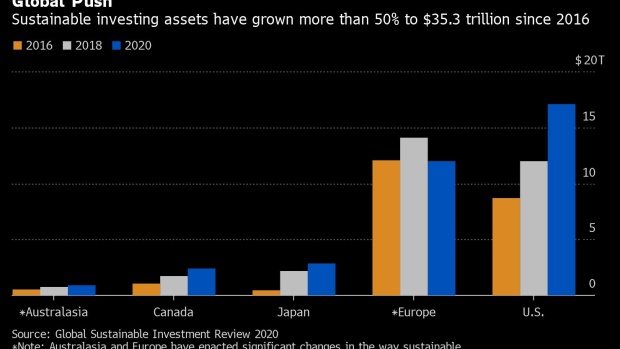

“While Europe has historically led on ESG assets, the U.S. has seen over 40% growth over the past two years and now accounts for $17 trillion,” or almost half of the global $35 trillion of assets under management, said Adeline Diab, head of ESG and thematic investing for EMEA and APAC at Bloomberg Intelligence. (For more on BI’s latest ESG research and related content, see NI ESGDAILY.)

A report published earlier this week by the Global Sustainable Investment Alliance said the European market for ESG assets contracted by $2 trillion between 2018 and 2020 following the introduction of anti-greenwashing rules.

Sustainable investment assets fell to $12 trillion in Europe during 2020 from $14 trillion in 2018, the report states. The decline isn’t the result of less investor enthusiasm for ESG investments, it’s because policy makers have tightened the parameters for what can be considered a responsible investment, said Simon O’Connor, chair of the GSIA.

Diab said regulators are increasing their scrutiny of the ESG market as more and more investment products are re-branded as conforming with environmental, social and governance factors.

ESG assets surpassed $35 trillion in 2020, up from $30.6 trillion in 2018 and $22.8 trillion in 2016, and now represent about a third of total global assets under management, according to the GSIA. Assuming 15% growth, half of the pace of the past five years, ESG assets are on track to exceed $50 trillion by 2025, according to BI.

©2021 Bloomberg L.P.