Feb 23, 2023

ESG Shock That Hit BlackRock, Pimco Triggers Split in EU

, Bloomberg News

(Bloomberg) -- European Union efforts to address criticism of its ESG investing rulebook are being challenged by the financial supervisory authority of France.

The French watchdog wants the EU to quickly adjust the legislation that underpins the bloc’s landmark ESG investing rulebook, instead of waiting for a planned review of the regulatory framework to run its course. The investment industry needs a faster solution than the one currently envisioned by the EU’s executive arm, according to Jerome Reboul, managing director of regulatory policy at Autorité des Marchés Financiers.

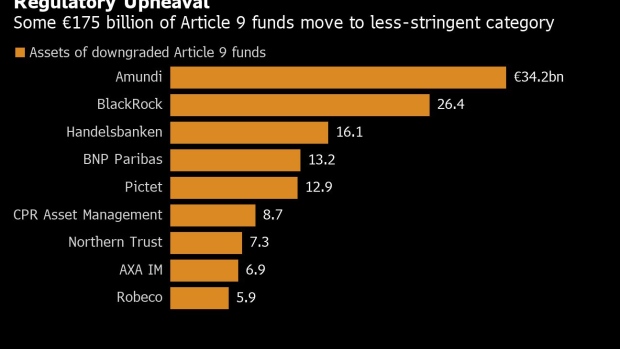

The comments follow a wave of fund reclassifications that hit some of the world’s biggest asset managers, including BlackRock Inc., Pacific Investment Management Co. and Amundi SA, after the EU Commission updated rules first enforced in March 2021. The EU’s top environmental, social and governance fund classification, known as Article 9, was wiped off €175 billion ($190 billion) of client assets in the fourth quarter alone, with more to come, analysts at Morningstar Inc. estimate.

The industry is now increasingly concerned that a similar fate awaits a weaker ESG fund class, known as Article 8.

The EU Commission has acknowledged that the bloc’s ESG investing rulebook, the Sustainable Finance Disclosure Regulation, needs to be improved. Mairead McGuinness, the EU’s financial markets and services commissioner, said in December she’s aware there’s a “lack of clarity” overshadowing SFDR which is creating “opportunities for greenwashing.” To address such issues, she’s planning a consultation process, and has said a more fundamental overhaul of SFDR may be needed.

“The commission has agreed that SFDR would need to be reviewed,” Reboul said in an interview. “We think we should consider the opportunity to do a quick fix.”

The French regulator said such a fix would entail going back to the original legislation that created SFDR, rather than making surface adjustments later this year.

Failure to act soon would mean “we are going to see a lot of pressure on supervisors, including on us, to do something to provide clarity,” Reboul said. “And we might do that in a disorderly way because each and every national competent authority is going to do that on its own.”

Introduced almost two years ago, SFDR was hailed as a groundbreaking initiative to puncture inflated environmental and social promises by managers of investment funds and to channel capital into sustainable assets. But after beating other jurisdictions to the finish line, the EU has since had to acknowledge that its ESG investing rulebook contains a number of holes. Among those is the absence of a clear definition of “sustainable investment.”

Reboul said the French regulator has done some research to get a sense of how that’s affecting the industry. In response to a question to investment managers asking them to identify the share of sustainable assets in common indexes, the regulator received “widely diverging” responses, he said. What’s more, under the current framework, it’s not possible for a national regulator to know whether SFDR allows Article 9 funds to hold fossil fuels, according to Reboul.

The French regulator this month proposed minimum environmental standards for Article 8 and 9 funds, and wants fossil fuels that aren’t aligned with the EU’s green taxonomy to be excluded from Article 9 funds. An EU Commission spokesperson said it “will carefully consider this contribution, among others, as part of the comprehensive assessment of SFDR announced by Commissioner McGuinness on 5 December.”

“We are aware of the concerns expressed by National Competent Authorities and others that SFDR is in practice used as a de facto labeling scheme, raising concerns about potential risks of greenwashing,” the spokesperson said. “This will be one of the issues we will be assessing as part of the comprehensive assessment of SFDR.”

Lawyers looking at the French watchdog’s proposal have voiced misgivings. Enforcing minimum environmental standards would be “technically challenging,” according to Maria Merry del Val of MJ Hudson, whose clients include abrdn Plc, Lloyds Banking Group Plc and Bank of New York Mellon Corp. According to Merry del Val, one key question becomes whether the proposed French plan risks triggering “a massive wave of SFDR downgrades.”

Part of the problem has been that SFDR has been used as a labeling system, for which it wasn’t designed. Asset managers are required to disclose information about products depending on how they categorize them: an Article 6 designation means a fund sets no ESG objectives. Article 8 means a fund “promotes” ESG characteristics, while Article 9 sets an ESG “objective.”

The EU has subsequently said the Article 9 tag must be reserved for funds that target 100% sustainable investments, with some allowance for hedging and liability. The European Securities and Markets Authority now wants to add minimum thresholds that look set to trigger a wave of Article 8 downgrades.

The ESMA proposal, for which a consultation period ended on Feb. 20, is an attempt to address the confusion that’s still gripping the investment industry. Reboul said it “correctly identifies the issue,” without addressing the root of the problem, which is the absence of a clear definition of “sustainable investment.”

“The deep problem that we have comes from the fact that the SFDR level one text doesn’t introduce a strict definition,” Reboul said.

European regulators have asked the commission to provide better guidance. For now, McGuinness has said there are signs that the asset management industry has tended to be “liberal” in its use of ESG classifications. She said in December that a “comprehensive assessment” of SFDR is needed.

Reboul said that while the French regulator appreciates the commission’s desire “to do a wider assessment of the effect of SFDR and then to put the proposal for review,” the process risks being too slow.

“Not everything is bad, but we do feel that we shouldn’t leave it to the market to structure itself for too long,” Reboul said. “In a number of cases, asset managers themselves have troubles figuring out exactly what they should consider to classify funds as Article 8 or Article 9. On top of that, actual practices are deeply diverging.”

It’s a situation that Reboul said “cannot last for long.”

--With assistance from John Ainger.

(Adds comment from lawyer in 13th paragraph)

©2023 Bloomberg L.P.