Sep 13, 2022

Ether Lags Bitcoin in Countdown to Revamp of Ethereum Blockchain

, Bloomberg News

(Bloomberg) -- Bitcoin tumbled more than 10%, the biggest decline since cryptocurrencies plunged in June, as the broad-based selloff in financial markets spilled over into the digital-asset sector.

Ether fell almost 9% to $1,571 even as its underlying Ethereum network is poised for a long-anticipated energy-saving software upgrade. Tether, the largest so-called stablecoin, is the most traded token on Tuesday as investors seek shelter from the sector’s volatility. Other stablecoins such as Binance USD and USD Coin also saw a jump in volume.

US stocks fell and Treasury yields spiked higher after hotter-than-expected inflation data fueled bets on a jumbo hike by the Federal Reserve next week.

“Today’s dump in the crypto markets is all about the US CPI,” said Teong Hng, chief executive at crypto investment firm Satori Research.

Bitcoin fell as much as 11% to $20,056, the biggest intraday decline since the largest cryptocurrency by market value fell 15% on June 18 in the wake of the collapse of crypto lender Celsius. Bitcoin is down about 56% this year.

Ether-based investment products saw outflows of about $62 million last week, accounting for the bulk of the cash pulled from digital-asset vehicles, according to data from CoinShares.

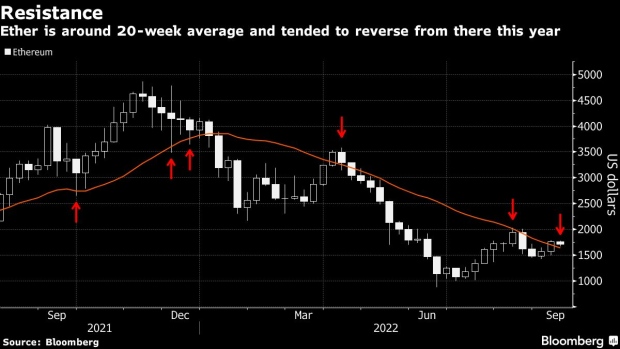

In the derivatives market, more crypto traders are shorting Ether ahead of Ethereum’s biggest technical upgrade.

“The ETH merge has been a non-event today,” said Kevin March, founder of Floating Point Group, a crypto trading platform provider.

©2022 Bloomberg L.P.