Sep 15, 2022

Ether Miners Are Piling Up Losses As ‘Merge’ Shifts Them to Altcoins

, Bloomberg News

(Bloomberg) -- Ether miners are piling up losses after shifting to lower value cryptocurrencies such as Ethereum Classic and Ravencoin, in the wake of an Ethereum network upgrade that rendered much of their operations obsolete.

The upgrade, known as the ‘Merge’, replaced powerful graphic cards used by Ether miners with investors who stake Ether, in order to secure the Ethereum network and validate transaction data encrypted by the blockchain.

The tokens that the miners are now seeking to mine still operate under Ethereum’s old consensus mechanism, called proof of work. This means that miners can still use their graphic processing units (GPUs) to earn these coins. However, miners must compete to be the first to solve a mathematical puzzle to win a limited amount of coins as rewards. The more miners there are, the smaller the reward. Subsequently, an influx of computing power from Ether miners has driven mining revenue to below zero for the other major alternative coins.

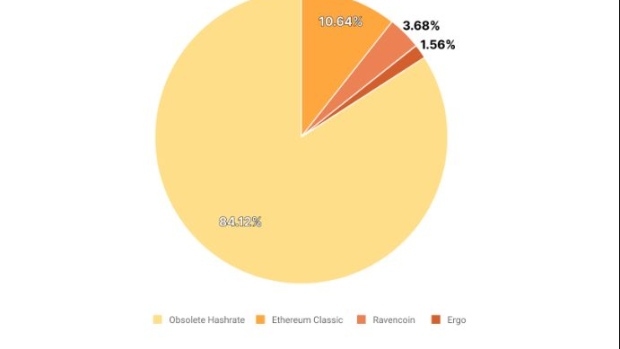

Those mining Ethereum Classic for a profit “are operating at negative 30% to 40% of gross profit margins, even the best operators,” estimates Ethan Vera, chief operations officer at crypto-mining firm Luxor Technologies, which used to provide Ethereum mining services. Around 25% of computing power is flowing from Ether miners to other coins, Vera calculates, using data from MiningPoolStats, a website tracking computing power as reported by major crypto-mining companies.

It will be easy enough for miners to switch to Ethash alternatives and other GPU-mineable coins after the Merge. The problem is, there’s a limit to how much computing power these other networks can absorb before the average miner becomes unprofitable — and it isn’t much, writes Colin Harper, head of content and research at Luxor.

“As it currently stands, I expect some of that computing power for Ethereum Classic will drop off the network because it is unprofitable to mine for even people with good gear and low-cost power,” said Vera.

As many as one million people were mining Ether with over $10 billion dollars worth of mining equipment before the Merge, which was completed early on Thursday morning, New York Time.

Post-Merge, some large-scale Ether miners such as HIVE Blockchain Technologies Ltd. and Hut 8 Mining Corp. are planning to use their facilities for other purposes, such as high-performance computing. However, the majority of Ether miners lack the same ability to scale up or the business setup to pursue this, according to Vera.

©2022 Bloomberg L.P.