Sep 27, 2022

Ethereum’s Merge Could Mean ‘Big Headache’ for UK Taxman

, Bloomberg News

(Bloomberg) -- An upgrade to the blockchain backing the world’s second-biggest cryptocurrency could trigger widespread tax confusion in the UK, potentially setting back the country’s efforts to establish itself as a crypto hub.

After a shift known the Merge, holders of Ether can choose to lock up, or stake, their coins on the Ethereum blockchain to help validate transactions, earning yields as high as 5.2% by one estimate. That’s expected to push staking, until now the domain of more sophisticated crypto investors, into the mainstream.

Unlike most other countries, the UK has already issued guidelines on how staking should be treated for tax purposes, which put increased onus on investors to figure out what they might have to pay. Further complicating matters, the vast majority of employed Britons aren’t currently required to file annual returns, potentially adding a big administrative burden on authorities should people who engage in staking be forced to do so.

U.K. Tax Regulator Toughens DeFi Stance And Crypto Isn’t Happy

Tax officials “are going to give themselves a quite a big headache if they suddenly require a lot of people to file tax returns just for their crypto,” said David Wren, a tax partner at EY. “So it’s not just that the tax position isn’t great, it’s also that the administration is not great on either side.”

The backlash against the UK’s staking tax guidelines, announced seven months before the Sept. 15 completion of the Merge, could threaten efforts by UK officials to gain an edge over jurisdictions like the EU in the midst of a leadership transition.

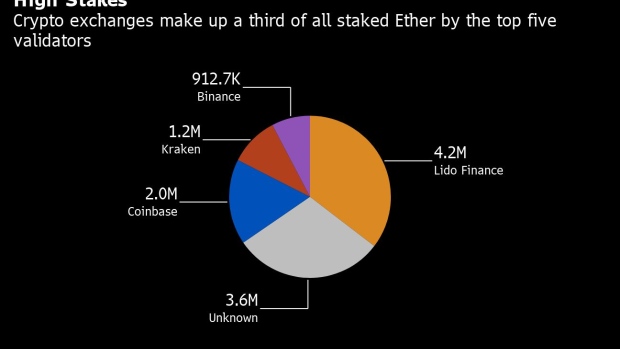

Following Ethereum’s switch to a “proof of stake” model for validating and ordering transactions, more investors will be encouraged to lock up their Ether tokens in special staking wallets that can earn them passive returns. About 12% of all eligible Ether in circulation — worth approximately $25.2 billion at prevailing prices — was locked up in staking wallets as of Monday, according to Staking Rewards.

Ethereum is the most commercially important network in crypto because it underpins most decentralized-finance applications, and is also the most popular platform for minting nonfungible tokens.

The UK’s HM Revenue and Customs updated its framework for cryptoassets earlier this year to include decentralized finance. Staking is considered a key part of DeFi, where investors can trade, lend or borrow digital tokens. The revamped guidelines said investors must consider the terms and conditions under which different platforms offer staking to determine if they must pay additional levies.

If a platform has use of a person’s tokens while holding them, HMRC said that could indicate beneficial ownership of those coins has passed and would be treated as a disposal, which incurs capital gains tax.

That would be the likely scenario for people staking their Ether on crypto exchanges, according to Wren and Jonanthan Peall, a tax director at KPMG UK. This is because exchanges will group together staked tokens from multiple users to run their services, and they also typically don’t provide a time frame for returning the tokens to holders.

Most people are expected to use exchanges for staking their assets because of the technical knowledge and capital required to be a validator on the Ethereum blockchain. Validators who run their own nodes on the blockchain are “not covered within the DeFi guidance,” HMRC said in a response to questions from Bloomberg News.

US, India Treatment

Earnings from staking cannot be considered as interest, the guidance added, as cryptoassets aren’t considered currency or legal tender in the UK. That means returns from staking would be subject to income tax, which can rise to rates as high as 45%.

Unlike in the US, workers in the UK don’t have to file tax returns unless they have earnings from investments. That means there’s a lower awareness among people about the requirement to file returns in such cases, according to Wren and Peall.

“One of the challenges for any tax authority is, are you are you causing a lot of people to suddenly file a tax return that weren’t previously?,” Wren said.

Other major regions don’t have specific guidance for staking yet. Joseph Riley, a tax partner for law firm Dechert Llp, said staking rewards in the US could face a levy of up to 37% under federal income tax rules. Meanwhile in India, experts said the yield earned from staking at the moment of receipt would likely be considered as income, and then subject to its 30% blanket tax rate.

‘Full of Problems’

Ian Taylor, head of industry lobby group CryptoUK, called HMRC’s initial guidance “full of problems, overburdensome, and very difficult to value and enforce.” While the sector has expressed some optimism about a consultation that the authority has since held with industry participants about ways to improve the tax system, Taylor said it’s important for the UK to get it right as other jurisdictions will likely soon develop their own rules.

“HMRC is currently analysing the responses to the DeFi call for evidence,” the department said in the response to Bloomberg. “A summary of responses will be published in due course together with details of the next steps.”

One possible solution initially presented by HMRC would require classifying digital assets as securities -- something the crypto industry worldwide has vigorously resisted because of the added regulatory burden it would bring.

“We don’t want that because tokens aren’t securities,” Taylor said in an interview, noting the extra work required if crypto tokens were to become regulated like equities or bonds. “Any way you look at it, it’s not perfect.”

©2022 Bloomberg L.P.