Jun 27, 2022

EU Confronts Risks of Low Gas Storage in Test of Unity on Russia

, Bloomberg News

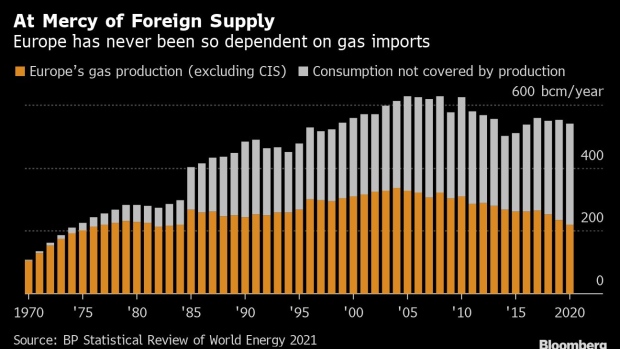

(Bloomberg) -- European Union governments are confronting the risk of a splintering energy market as Russian cuts in natural-gas supplies test EU unity in response to the war on Ukraine.

An increase in gas supply disruptions following EU sanctions on Russia is prompting member countries to step up winter preparations as they seek to fill depleted storage. EU energy ministers will discuss risk preparedness at a meeting on Monday in Luxembourg, according to diplomats.

Gas reserves in the EU -- Russia’s biggest customer -- are the buffer that would allow countries to move it across borders, help each other and avoid countries rushing to cover their own needs if the crisis escalates.

“The key risk looming ahead for Europe is the fragmentation of its energy market in case of a full interruption of Russian flows -- that is, a situation where countries react by closing down their energy market borders, ” said Simone Tagliapietra, researcher at Bruegel, a Brussels think tank.

The European Commission has already called on member states to update their contingency plans. It’s seeking to present a proposal in July on how the EU could reduce demand.

Inflation-fueling record gas and power prices in the wake of Russia’s invasion of Ukraine have forced the Kremlin’s use of energy as a weapon to the top of the EU’s agenda. Curtailed Russian shipments have affected 12 member states and prompted Germany to raise its gas-risk alert to the second-highest “alarm” level last week.

Risks of deeper supply cuts are mounting as Russia’s Nord Stream pipeline to Germany, already operating at just 40% of capacity, will shut for maintenance for 10 days next month.

Warnings by European leaders multiplied last week.

German Economy Minister Robert Habeck said he can’t be sure that Russia will resume shipments after the Nord Stream work has been completed. Greek Prime Minister Kyriakos Mitsotakis called for a united approach, saying EU discussions have already begun.

“Not every country can move on its own,” he said Friday after an EU summit, adding that “in interconnected markets we have an obligation to work together and coordinate.”

Reduced Russian flows are forcing EU members to revive coal power plants and accelerate the search for alternative suppliers.

The concern is that Europe will fail to reach its target of 80% storage filling by Nov. 1 if Nord Stream operates at its limited capacity or halts completely, according to Wood Mackenzie Ltd. In the worst case, the region risks running out of gas stockpiles in the middle of peak winter demand.

EU gas storage levels were 55% on June 22 compared with the five-year seasonal norm of 57% for this time of year.

“In order to meet the refilling target, greater intervention would be required,” Tagliapietra said. “In such a scenario emergency plans may be triggered in some EU countries to further reduce demand and allocate available gas between countries.”

©2022 Bloomberg L.P.