Mar 8, 2023

EU’s Fastest Inflation Finally Slows as Hungary Faces Recession

, Bloomberg News

(Bloomberg) -- Hungary’s central bank Governor skewered Prime Minister Viktor Orban for a series of “strategic mistakes,” adopting unusually blunt criticism for the powerful premier over spending and state intervention. The forint fell.

Governor Gyorgy Matolcsy, once a close adviser to Orban on economic policy, told lawmakers in Budapest that there was “principled opposition” now between the central bank and government, underscoring a widening rift.

“We lost our way,” Matolcsy said on Wednesday. “Economic policies that focused on balance and brought success to Hungary have unraveled.”

The institutions had been accustomed to moving in tandem since Orban first tapped Matolcsy, his former economy minister, to oversee monetary policy a decade ago. Several lawmakers called the direct criticism of Orban, who has spent that time in office consolidating power and sidelining rivals, unprecedented.

Hungary’s forint weakened as much as 0.8% against the euro on Wednesday amid a wider regional selloff, paring its year-to-date gains to about 5%, still one of the best globally.

Matolcsy took aim at the premier for carrying out a pre-election spending spree last year and introducing a food price cap, which the central banker said backfired. The steps raised interest payments and worsened a downturn, he said.

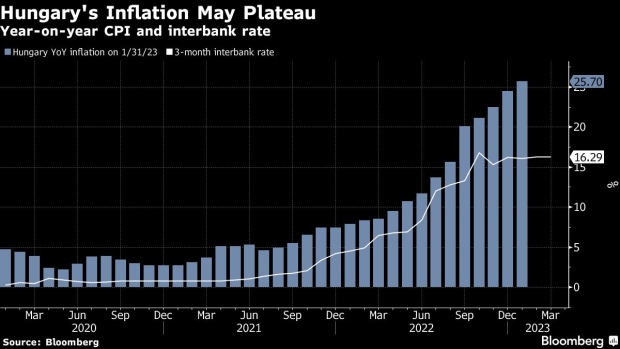

The criticism overshadowed a marginal improvement in inflation, the European Union’s fastest, which had eased for the first time in 19 months. Investors have been watching the data closely for any sign of a thaw in the National Bank of Hungary’s policy, which has kept the key interest rate at an EU-high of 18%.

Fueling Tension

Matolcsy’s remarks “may fuel tension between the NBH and the government,” said Piotr Matys, a senior currency analyst at In Touch Capital Markets in London. “This could lead to political pressure on the NBH to start cutting rates,” which could raise questions about the bank’s independence, he said.

Policy makers under Matolcsy have backed a more cautious approach to monetary easing, after a premature end to a rate-hike cycle last year pushed the forint to a record low against the euro. Monetary policy will continue to be “disciplined,” Deputy Governor Barnabas Virag told parliament on Wednesday.

Orban’s government has urged the central bank to cut interest rates rapidly to blunt the negative impact on the economy. Hungary entered a recession in the second half of 2022, and a plunge in retail sales and industrial production in January suggest the downturn may be deeper than the government expected.

The central bank has said the key rate is its main tool to rein in inflation and anchor the economy as the government struggles to gain access to more than $30 billion in EU funding held up on graft and rule-of-law concerns.

Orban is expected to respond to the central bank’s criticism at an economic forum on Thursday, an annual event which until this year always featured Orban and Matolcsy on the same podium.

This year, the governor wasn’t invited to the event organized by the Hungarian economic chamber, underscoring the chill between the two men even as Matolcsy played down the appearance of a rift.

“Is the central bank governor offended? Is he frustrated? Did he fall out with the prime minister?,” Matolcsy asked rhetorically in parliament. “No, God forbid! There is principled opposition between the central bank and the government.”

--With assistance from Marton Kasnyik and Veronika Gulyas.

(Updates with deputy governor comment in 9th paragraph.)

©2023 Bloomberg L.P.