Feb 7, 2019

EU Slashes Growth Forecasts and Warns Over Brexit, China

, Bloomberg News

(Bloomberg) -- Sign up to the Brussels Edition, a daily briefing on what matters most in the European Union.

The European Commission slashed its growth forecasts for all the euro region’s major economies from Germany to Italy and warned that Brexit and the slowdown in China threaten to make the outlook even worse.

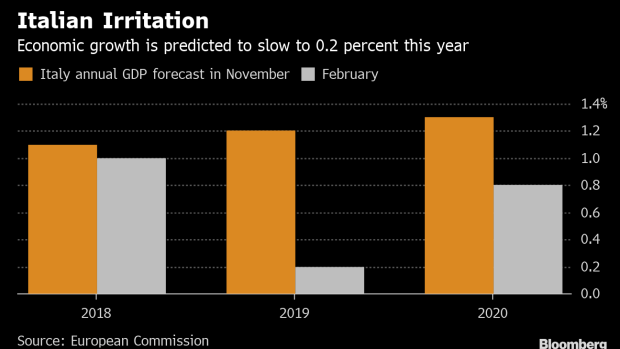

The European Union’s executive arm delivered a downbeat report on Thursday that shaved a whole percentage point off its 2019 projection for Italy, now seen with minimal expansion of just 0.2 percent for the whole year. Officials in Brussels warned that the region’s outlook faces “substantial” risks.

The gloomier outlook reflects more pronounced weakness in the region, which stumbled at the end of 2018 as political instability continued to rock Italy, violent protests in France depressed output, and Germany’s car industry struggled to rebound from changes in regulation. Global trade uncertainty and a sharper-than-expected slowdown in China also pose external risks to the economic outlook.

In its forecasts, the commission sees the 19-nation euro-area economy expanding 1.3 percent this year down from 1.9 percent projected in November. For 2020, it sees growth of 1.6 percent, down from 1.7 percent forecast earlier.

Italy’s downward revision was the starkest, with the commission seeing growth slowing to 0.2 percent -- the lowest in the bloc by far -- compared with its previous forecast of 1.2 percent. The lowered outlook comes two months after Rome and Brussels reached a compromise over Italy’s deficit target and will likely make it more difficult for the populist coalition to carry out its expansive spending plans.

Clouds Gathering

"Much of the euro area’s loss of growth momentum can be attributed to fading support from the external environment, including slower global trade growth and high uncertainty regarding trade policies," the commission said. "However, there have also been a number of domestic factors at play," it said, pointing to social tensions and budget-policy uncertainty in some countries, as well as weakness in the car industry.

Clouds on the horizon are also getting darker, the commission said. “In the U.S., the risk of an abrupt fiscal tightening appears to have increased, especially for 2020,” according to the report. “The Chinese economy might be slowing more sharply than anticipated while many emerging markets are still vulnerable to sudden changes in global risk sentiment.”

For the European Union, Brexit remains a source of uncertainty, the commission said.

An increasingly anemic economy will test the resolve of the European Central Bank in sticking to its plans to gradually pare back its crisis-era stimulus. ECB policy makers already walked a fine line in December by downgrading economic forecasts at the same time as ending net asset purchases that have helped buoy euro-area demand.

On inflation, the commission cut its 2019 euro-area forecast to 1.4 percent, down from 1.8 percent in earlier projections. The ECB aims to get inflation to just below 2 percent over the medium term.

--With assistance from Nikos Chrysoloras, Zoe Schneeweiss and Jana Randow.

To contact the reporter on this story: Viktoria Dendrinou in Brussels at vdendrinou@bloomberg.net

To contact the editors responsible for this story: Ben Sills at bsills@bloomberg.net, ;Fergal O'Brien at fobrien@bloomberg.net, Jones Hayden, Kevin Costelloe

©2019 Bloomberg L.P.