Sep 18, 2019

EU Steel Imports Jump to Decade High as Quotas Reset in July

, Bloomberg News

(Bloomberg) -- Terms of Trade is a daily newsletter that untangles a world embroiled in trade wars. Sign up here.

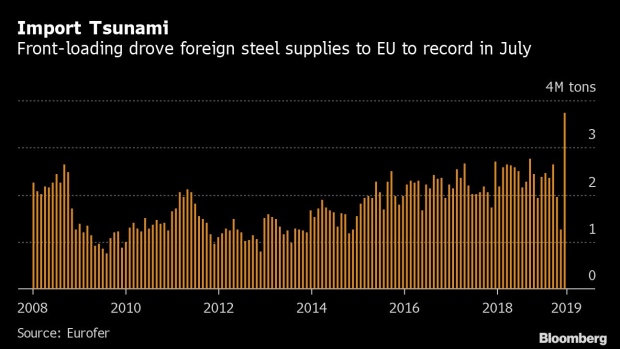

The European Union saw steel imports rise to the highest in more than a decade in July as the 28-nation bloc reset quotas for foreign suppliers.

Shipments totaled 3.74 million tons, the highest in data running back to 2008, according to European industry group Eurofer. Supplies from China and Turkey surged after two months of declines, as foreign sellers raced to fill new tariff-free quotas introduced by the European Commission on July 1.

The “extreme” steel deliveries came as “traders and buyers rushed to fill key product categories almost as soon as quotas reset,” Jefferies Group LLC said in a note Wednesday.

EU steelmakers including the world’s biggest producer ArcelorMittal have blamed U.S. tariffs for an influx of low-cost imports that have left Europe’s steel industry in crisis. Coupled with weak demand from the key auto sector, that pushed EU steel prices to multi-year lows even as raw material costs increased. ArcelorMittal has lost 18% of its market value this year and cut production in Europe.

China, which pushed its output to a record in June, shipped the most steel to the EU since 2015, according to Eurofer data. Turkey, boosted deliveries in July to a fresh record as its domestic demand remains poor.

Europe’s producers are expecting some relief later this year as EU leaders agreed to changes to import quotas from October. The tweaks include a rule that no exporting country can have a greater than 30% share of hot-rolled coil imports, the biggest category of steel supplies, in any given quarter. That’s expected to most impact Turkey.

To contact the reporter on this story: Elena Mazneva in London at emazneva@bloomberg.net

To contact the editors responsible for this story: Lynn Thomasson at lthomasson@bloomberg.net, Dylan Griffiths, Liezel Hill

©2019 Bloomberg L.P.