Jan 31, 2022

Euro Area Scrapes By Second Winter of Pandemic With Mild Growth

, Bloomberg News

(Bloomberg) --

The euro-area economy grew modestly in the fourth quarter amid another wave of surging coronavirus infections and curbs on activity.

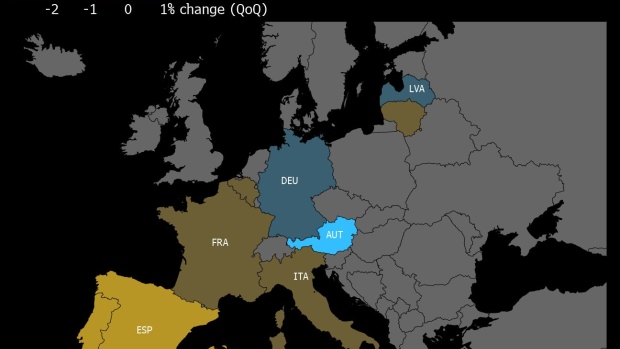

Gross domestic product rose 0.3%, slightly less than predicted, after a sharp contraction in output left Germany on the brink of recession. Meanwhile, a ramp-up in investment contributed to stronger-than-expected growth in France and Spain. Italy reported an expansion of 0.6% on Monday.

The region’s economy is tackling headwinds better than earlier in the pandemic as businesses find ways to cope with restrictions and more people get vaccinated, but it’s still lagging recoveries in the U.S. and the U.K. Supply bottlenecks have weighed on manufacturing-heavy Germany for months, and coronavirus curbs are now disrupting all parts of the economy.

Euro-area output increased 5.2% in 2021. European Central Bank President Christine Lagarde said in December she expects economy to reach pre-crisis levels in the current quarter.

What Bloomberg Economics Says...

“The emergence of the omicron variant of Covid-19 may have had a modest additional impact on activity in 4Q. But with the spread of omicron yet to peak in many euro-zone economies, it poses a bigger risk to growth in 1Q. Our base case is that activity holds up better than during previous waves of the virus and the euro-area economy expands by 0.8% this quarter.”

--Jamie Rush and Maeva Cousin. To read their full report, click here.

ECB officials will meet this week and are expected to affirm a plan to halt emergency asset purchases this March. Inflation surged to a record 5% in December, adding to pressure on the institution to begin gradually withdrawing pandemic support.

Price surges are a major concern for the euro-area economy, according to a Bloomberg survey. Last week, the International Monetary Fund has also warned inflation in the region will persist for longer and cut its growth projection for the year ahead.

In one sign that the outlook may improve, purchasing managers’ indexes for January showed that supply-chain snarls are starting to ease. The pace of improvement will largely depend on the health situation in other parts of the world as strict Covid-19 controls in China and much of the rest of Asia could yet derail progress.

©2022 Bloomberg L.P.