Jun 14, 2018

Euro Falls as ECB Signals Rates to Be Frozen Through Summer 2019

, Bloomberg News

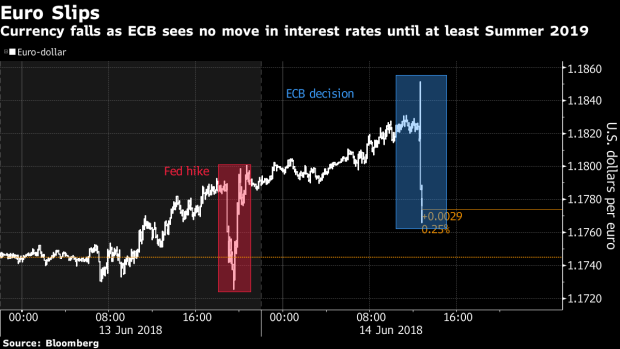

(Bloomberg) -- The euro declined and German bonds gained after the European Central Bank assured investors that it expects to hold interest rates until at least through the summer of next year.

Policy makers, however, set an end date for their 2.6 trillion euro ($3.1 trillion) bond-buying program in the latest sign that years of monetary loosening is coming to an end. Money markets are now pricing in a 10-basis point increase to the deposit rate in September 2019, compared with 15 basis points on Wednesday.

Since the inception of its bond-buying program in 2015, the ECB has ploughed billions of euros into the region’s debt markets. German bonds have been among the biggest beneficiaries, with yields dropping to record lows and even briefly falling below zero percent. The central bank has held its deposit rate at minus 0.40 percent for more than two years, having not raised it since 2011.

“Bunds are rallying, most likely due to rate outlook being tied in with sustainable inflation path,” said Orlando Green, a strategist at Credit Agricole SA. “The statement does look dovish but still in line with our call for the first hike coming in September 2019.”

The euro fell 0.4 percent to $1.1750 ahead of the ECB’s press conference due at 1:30 p.m. London time. German 10-year yields dropped one basis point to 0.47 percent.

Expectations for an end-date to quantitative easing grew after the ECB’s chief economist Peter Praet signaled that Thursday’s meeting could be pivotal.

To contact the reporter on this story: John Ainger in London at jainger@bloomberg.net

To contact the editor responsible for this story: Ven Ram at vram1@bloomberg.net

©2018 Bloomberg L.P.