Apr 20, 2022

Euro Notches Biggest Drop as Global Payment Currency Since 2011

, Bloomberg News

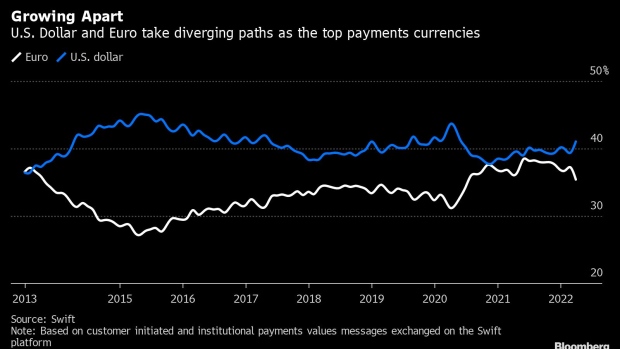

(Bloomberg) -- The euro is being used less often as a global payment currency, posting its biggest percentage-point drop in more than a decade in March, as inflation and the war in Ukraine weigh on its appeal for transactions.

Meanwhile, the U.S. dollar remained in the top spot for a 10th consecutive month, and has dominated global payments for the most part since 2013, according to data from the Society for Worldwide Interbank Financial Telecommunications, or SWIFT.

Payments using the euro dropped to 35.4% of market share, the lowest proportion since the early months of the pandemic, according to SWIFT. The global financial messaging firm serves more than 11,000 financial institutions and 200 countries. Swift made headlines last month when sanctions barred several Russian banks from the platform.

Geopolitical uncertainty and global inflation have driven business transactions toward the greenback as a haven. The dollar clocked in as the most-used currency for global payments last month, increasing to 41.1% of all Swift transactions, its largest proportion since April 2020.

Despite a rout in the Japanese currency, which fell to a 20-year low against the dollar this month, the yen gained some ground in usage in March, rising to 2.8% of payments, the most since October. The Australian dollar’s share dropped slightly.

Meanwhile, the Chinese yuan’s share of transactions fell to the lowest since November as the country’s economy remains beleaguered by recent Covid lockdowns. On Monday, bleak consumer spending and unemployment data further bolstered those economic worries.

©2022 Bloomberg L.P.