May 26, 2019

Euro Rises as Mainstream Europe Holds Populist Parties at Bay

, Bloomberg News

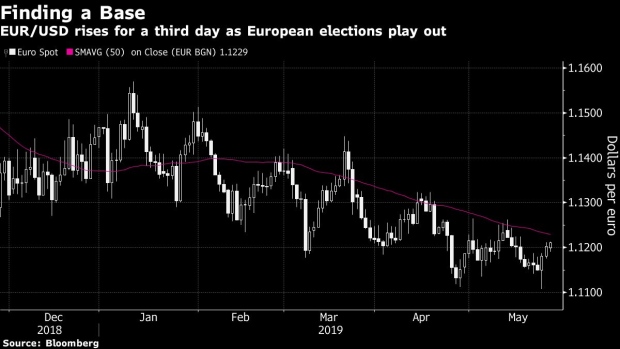

(Bloomberg) -- The euro rose, reversing an earlier decline, as initial exit polls showed mainstream European Union parties held their ground against populists in elections for the bloc’s Parliament.

The common currency climbed 0.1% to $1.1211 as of 7:29 a.m. in Sydney, rising for a third day as early results Client pointed to populist parties winning 29% of the Europe-wide vote, down slightly from 30% in the current Parliament, according to official EU projections. The two big alliances will make up 43% of the seats, down from 56% in 2014.

The early polls suggest key policies for the bloc are unlikely to be reversed, potentially helping to pare declines in the currency so far this year. The euro has fallen against most Group-of-10 peers as measures of regional manufacturing and business confidence pointed to uneven growth.

“There is plenty of uncertainty already factored into the euro at present,” said Sandeep Parekh, a foreign exchange and rates strategist at ANZ Bank New Zealand in Auckland. “Should the result come in as the polls suggest, it would suggest that it’s business as usual for the EU and possibly see the euro firming in the near term.”

Support for Chancellor Angela Merkel’s Christian Democrats was at 28% in Germany against 35% in 2014, with the pro-business Liberals and the Greens likely to garner 14% and 9% of the vote, respectively. The one big exception was France. where President Emmanuel Macron’s party was narrowly defeated by Marine Le Pen’s euroskeptic National Rally, according to exit polls.

The results come just as EU leaders begin their tussle over who should run the region’s monetary policy in the era after Mario Draghi. Heads of government will meet in Brussels on Tuesday to start talks on the next suite of top political appointments, including the bloc’s most-powerful economic job, the European Central Bank presidency.

--With assistance from Ruth Carson.

To contact the reporters on this story: Scott Hamilton in London at shamilton8@bloomberg.net;Michael G. Wilson in Sydney at mwilson176@bloomberg.net

To contact the editors responsible for this story: Ven Ram at vram1@bloomberg.net, Linus Chua, Ros Krasny

©2019 Bloomberg L.P.