Mar 24, 2023

Euro-Zone Core Inflation Set for New Record in Test of ECB Nerve

, Bloomberg News

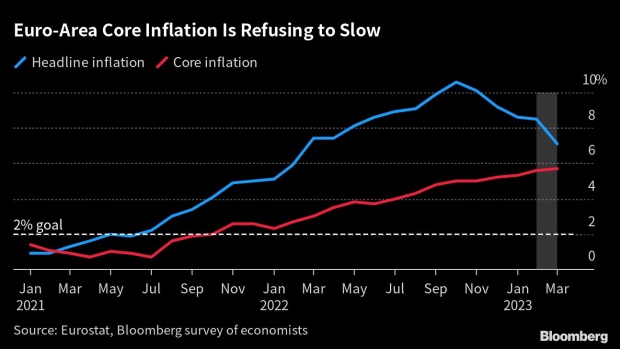

(Bloomberg) -- Underlying inflation probably reached a new euro-era record this month, an outcome likely to rile European Central Bank officials fretting about threats posed by banking turmoil.

The data for March due next Friday will show further acceleration in the so-called core gauge that strips out volatile elements such as energy and food, according to economists.

The median of 27 forecasts is for an increase in that measure to 5.7%, which would be the fastest pace since the euro was founded at the end of the 20th century. By contrast, headline inflation is likely to show a drastic deceleration, reflecting lower energy prices than a year earlier.

The report will further feed the intellectual battle at the ECB over how far and how aggressively to keep tightening monetary policy, not least as financial turmoil also troubles officials on the potential economic consequences.

Most are focusing their inflation worries on underlying price growth. Doves among them caution however that the overall measure is the one they’re actually targeting.

“The swift decline in headline inflation, driven by lower energy prices, is good news for households’ purchasing power,” Bloomberg Economics said in a report. “But it will do little to alleviate concerns at the ECB over upside risks to the medium-term outlook for inflation.”

ECB President Christine Lagarde articulated those worries on Wednesday, as she noted a lack of “clear evidence” that underlying price growth is slowing, with domestic pressures posing a threat there.

Conceivably, the upcoming data could have even more extreme outcomes. Among the highest forecasts for the core gauge are those by economists at Berliner Sparkasse and Swiss Life Holding, anticipating a 0.5 percentage point jump to 6.1%.

Similarly for the headline measure, the drop is seen by some economists — including those at Standard Chartered Plc — to be almost two percentage points.

Officials raised borrowing costs this month by 50 basis points, while giving no signal on future moves. Since then, hawkish policymakers have begun discussing further rate hikes, though an outbreak of market turbulence focused on Deutsche Bank AG is likely to spur renewed caution in that regard.

©2023 Bloomberg L.P.