May 26, 2023

Euro-Zone Crawl Toward 2% Inflation Keeps ECB in Rate-Hike Mode

, Bloomberg News

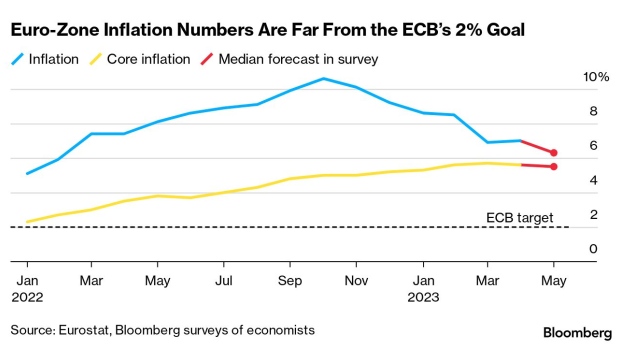

(Bloomberg) -- Euro-zone inflation data next week will probably show frustratingly slow progress toward the European Central Bank’s 2% target, keeping officials focused on the need for more interest-rate hikes.

Consumer prices rose 6.3% in May from a year earlier, according to the median of 35 forecasts in a Bloomberg survey. That’s down from 7% in April. Economists’ estimates for an underlying measure that strips out volatile elements such as energy point to a little-changed outcome of 5.5%.

That so-called core gauge may have not yet peaked in the current cycle, even if headline inflation is slowing as energy costs drop. It’s the underlying index that euro-zone policymakers are most focused on as they determine how far to keep raising borrowing costs.

“We expect to turn the corner, but I wouldn’t say we reached that corner quite yet,” ECB Chief Economist Philip Lane said on Friday. “We do think that this spectacular reversal of energy prices will feed into core, but timing is uncertain.”

Officials are currently penciling in rate increases at the next two meetings, with some, including Bundesbank President Joachim Nagel, openly talking of a third such move in September.

Such is the worry among ECB officials of persistently fast price increases taking hold that they are prepared to diverge and keep tightening even if a hiking pause signaled by the US Federal Reserve takes effect.

The euro-zone data will be released on Thursday, the same day the ECB celebrates its first quarter century. The report will mark the culmination of three days of national data from around the region. Numbers from all four of its biggest economies will show slowing headline inflation, according to forecasts collated by Bloomberg.

They may still reveal divergence across the euro zone. Spain’s measure on Tuesday is seen falling to 3.4% on the European Union-harmonized index, the median prediction shows.

By contrast, the forecasts point to equivalent data the next day from France, Italy and Germany all featuring inflation rates above 6%.

©2023 Bloomberg L.P.