Sep 26, 2022

Europe Firms That Refinance Bonds Face Highest Costs on Record

, Bloomberg News

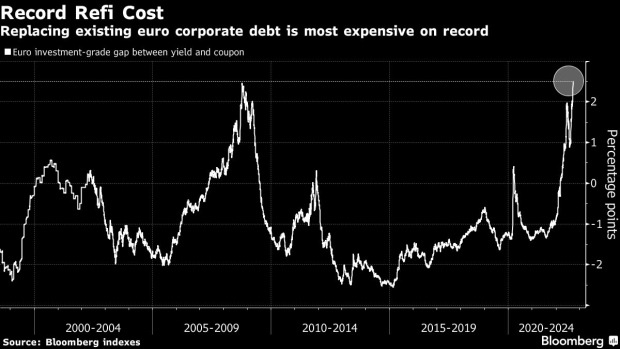

(Bloomberg) -- European companies that need to refinance their bonds have never been faced with costs this high.

The difference corporates need to pay if they sold bonds now compared to the coupons on their existing debt climbed to 250 basis points, the highest since a Bloomberg index of euro-denominated investment-grade bonds began in 1998. In other words, companies have to pay an additional 2.5 million euros ($2.4 million) for every 100 million euros that they borrow.

It’s a blow to a market that has spent most of the past decade with cheaper refinancing costs. At the start of the year, new bonds were about 90 basis points cheaper than outstanding debt. The magnitude of the spike this year is unlike anything the market has seen. The 339 basis point jump so far in 2022 through Friday is well over a 100 basis points above the last record set in 1999, according to the index. And given that the European Central Bank -- together with global peers -- is nowhere near ending its fight against inflation, refinancing costs are set to continue rising.

The majority of the index constituents are of corporate bonds issued by firms in the euro area, but just under 10% are British. While negative sentiment over the UK government’s tax cuts -- which sent the pound to an all-time low -- is raising credit risk for euro-denominated corporate bonds, the Bloomberg Euro-Aggregate has a one-day lag.

“Corporates are going into this challenging period from a position of strength, but the speed and magnitude in funding costs does point to a material increase in defaults, albeit from a very low base,” said Daniel Ender, a credit analyst at Actiam NV, which oversees about 22 billion euros. “Defaults will likely increase from historical lows to above their long-term average.”

That gives companies a headache they probably hadn’t planned for, at a time when supply chains are sill strained, costs are rising, and economies worldwide are edging closer to a recession. And in the midst of it all is an energy crisis driven by Russia’s war in Ukraine, which carries a plethora of uncertainties given President Vladimir Putin’s plan to boost defense expenditure.

More than a quarter of the roughly 750 junk-rated euro bonds tracked by a Bloomberg index are trading at distressed levels, compared to just two at the end of last year. ING Bank NV strategists expect the annual rate of default to rise to about 5.6% in Europe from under 2% currently.

Primary Market

But even for companies that decide to go ahead and refinance their bonds, they’ll be met with a market that has a clear preference for the safest of credits, and require significant extra costs.

Of the 138 syndicated bond tranches sold in Europe this month through Friday, 96% of them were by investment grade names. And the average new issue concessions they paid to get their deals done was about 12 basis points, roughly three-times more than the premium they paid this time last year, according to data compiled by Bloomberg.

“Worsening fundamentals should theoretically lead to more widening of spreads,” strategists Timothy Rahill and Jeroen van den Broek wrote in a note. “We expect to see more weakness and volatility for credit markets ahead.”

Elsewhere in credit markets:

Europe

There are just two issuers in Europe’s publicly syndicated debt market on Monday -- a single-A note and a covered bond -- for a minimum issuance volume of 1 billion euros. Issuance was low as volatility centered around the UK and Italy gripped markets.

- UK bonds plunged as traders ramped up bets on rate hikes by the Bank of England; British banks’ riskiest bonds fell, as did sterling-denominated junk bonds

- Giorgia Meloni won a clear majority in the Italian election and is set to form the country’s most right-wing government since World War II

- Matalan Ltd. reached an agreement to extend a key bond maturity and start a sale process after months of negotiations with its creditors

- Credit Suisse is said to be looking at possible asset and business sales to dive down costs and restore profitability

Asia

Concern is growing among investors that central bank policy tightening to tame inflation may cause a global recession, and that’s sparking increases in dollar bond spreads and debt insurance costs in Asia excluding Japan on Monday.

- Yield premiums on Asia ex-Japan’s high-grade US currency bonds widened at least 2bps, a trader said, headed for their steepest increase in about two weeks

- An index tracking credit-default swaps to insure against nonpayment of such notes rose about 7bps, two other traders said

- The lull in dollar deals continued in the Asian primary market, hobbled by a largely risk-off mood; just one company, Jiangning Jingkai Overseas Investment Co. based in China, was seen marketing debt on Monday

- Despite mounting signs of a sharp slowdown in growth, Bloomberg Intelligence says that policy makers will continue to raise interest rates; it forecasts that the GDP-weighted global central bank rate will rise to 5.1% at the end of 2022 from 2.9% at the end of last year

- “Seldom have the stakes for central banks been higher, or the trade-offs tougher,” according to BI analysts led by chief economist Tom Orlik

- In Japan, its usually staid yen corporate bond market hasn’t escaped the global debt rout: that market is poised for its first annual loss since 2011 amid the yen’s plunge versus the dollar

Americas

Month-to-date investment-grade volume stands at just $76.9 billion -- less than the $77 billion that priced in just the initial four sessions following Labor Day last year.

- The key question for high-grade credit in the coming weeks is whether interest-rate risk will morph into more extensive credit risk, JPMorgan analysts led by Eric Beinstein wrote in a note on Friday

- Borrowers in a part of the booming sustainable-debt markets have been offering to pay higher interest rates for falling short of climate or social goals. Now one country, Uruguyay, is proposing rewards for good performance too

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

©2022 Bloomberg L.P.