Mar 8, 2022

Europe Is on a Wartime Mission to End Its Addiction to Russian Fossil Fuel

, Bloomberg News

(Bloomberg) -- Russia’s invasion of Ukraine has brought a wartime energy transition to Europe.

The continent’s decades-long timelines for overhauling energy supply systems that support more than 440 million people are now being revved up under extraordinary duress. Policy is changing in real time as political leaders in capitals across the Europe adopt new positions by the day and missiles land on Kyiv.

As a deputy prime minister in Moscow threatened on Monday to stop flows of natural gas through the Nord Stream 1 pipeline, which supplied 38% of gas imported into the European Union last year, policymakers in Brussels were putting finishing touches on a new plan to slash Russian gas by more than two-thirds over the next nine months. In Washington and London, meanwhile, bans on Russian oil were announced on Tuesday, without waiting for European allies to move. The posture of the EU’s biggest economy has changed rapidly during the crisis, with Germany committing 200 billion euros to bring forward its goal of 100% renewable energy by more than a decade.

If Europe before the war had a long-term political agenda to remake its energy resources over decades in response to global warming, now the energy question is even more urgent: What can be done by next winter and beyond, in the name of cutting off the Russian economy from its largest source of trade? Or perhaps even by next month, if Russian President Vladimir Putin makes good on threats to respond to EU and U.S. sanctions with an energy embargo of his own?

The war in Ukraine has already revealed that the modern financial system can be weaponized in ways never before seen. Now the same might be true of the energy transition. Europe is suddenly going to test what is possible on a war footing, in a rush almost unprecedented in living memory now that the World War II generation is nearly gone. What follows is a guide to the new range of possibilities to suddenly shift away from Russia’s fossil fuels.

Phasing Out Russian Fossil Fuels

Europe spends as much as $1 billion a day to pay for coal, gas and oil imported from Russia — indirectly funding the war machine that’s rolling through Ukraine.

“Because of what’s happening in Russia, there are no taboos in the choices member states can make,” Frans Timmermans, the EU’s climate czar, told environment committee lawmakers on Monday. He left it up to each country to decide whether they will make up for burning more fossil fuels in the short term by boosting investments in renewables. In practice both will happen — an uptick in coal, oil and gas imported from non-Russian sources as well as a push to expand solar, wind and nuclear.

READ MORE: War Exposes Europe’s Failure to Heed Warnings Over Russian Gas

Coal is the easiest problem to solve, even with prices running to $400 per ton. The U.S. and Australia can together replace 70% of the Russian coal imported into the EU right now, says Brian Ricketts, secretary general at Euracoal, a trade group for Europe’s coal industry. Running existing coal plants at full throttle and postponing the retirements of others could help reduce Russian gas imports by 15% this year, according to the International Energy Agency. Buying coal from other sources will probably increase Europe’s costs by about 20 billion euros ($22 billion) compared with purchasing Russian supplies, according to Bloomberg estimates reflecting current prices for the fuel and carbon emissions in the EU.

Oil is politically trickier, but in a global market it’s a question of where to buy from and how much to pay. Spare capacity in Saudi Arabia, United Arab Emirates and Iraq could theoretically make up for Russian oil imports to Europe within months. But the first two countries have signaled they’re not interested in ramping up production. Removing Russian oil from from major markets means prices will likely continue rising, with traders predicting $200 a barrel by the end of the month. At that price, based on Bloomberg estimates, the EU would have to spend an extra 80 billion euros to purchase the crude it would have gotten from Russia this year.

Although shale could ramp up production faster than it is, U.S. producers have repeatedly said they will put maintaining profits above output growth. Depending on how far Western powers are willing to go, oil from sanctioned Iran and Venezuela could be brought back to global markets. A pair of senior U.S. officials went to Caracas this weekend to discuss easing oil restrictions with representatives of Venezuelan President Nicolas Maduro’s government, according to people familiar with the trip.

The dilemma around coal and oil isn’t so much their availability as their impact on the planet and the EU’s world-leading climate policies. Burning coal instead of gas would increase the EU’s emissions by about 8%, based on Bloomberg calculations. But a short-term increase in emissions may be the least bad option. Since Europe isn’t planning to build new coal power plants as part of its response to the war in Ukraine, any additional pollution created by new coal and oil imports can be cut once green replacements are scaled up.

That’s not the case with natural gas. Plans to boost alternative sources of the fuel relied on to heat millions of European homes mean building infrastructure that will lock in gas consumption for decades, while some countries may try to extract more gas at home.

The U.S. and Australia can together replace 70% of Europe’s Russian coal imports

It’s possible, based on IEA estimates, for Europe to cut Russian gas imports by a third or even by half by next winter. That will require more piped gas from Azerbaijan, Norway and Algeria while also buying more shipments of liquefied natural gas and fixing leaky pipeline infrastructure. The last step would also help stem methane emissions, a major source of global warming.

Bruegel, a Brussels-based think tank, went even further by suggesting the EU could survive next winter if all Russian pipeline imports were halted, though it would require painful measures including power rationing. Filling up gas storage from non-Russian sources would cost between 60 billion euros to 100 billion euros, according to Aurora Energy Research.

Neither suggestion for the near-future of natural gas is as ambitious as what the EU itself is now contemplating by replacing about 102 out of 155 billion cubic meters it would have imported from Russian this year. The proposal heavily relies on being able to buy LNG instead, pitting Europe against major buyers such as Japan and China, the largest global importer of the liquefied fuel.

Will Energy Cutbacks Weaken Putin?

For European citizens watching Russia’s attack on Ukraine unfold on social media and television in gory, heart-breaking detail, a common response has been a desire to help. There have been marches in support of Ukraine in cities across Europe. But there’s really one tangible way the average person can weaken Putin’s armed forces: decrease the consumption of gas to heat their home, oil to fuel their car and coal to generate their electricity.

Lowering European thermostats by 1° Celsius (about 2° Fahrenheit) would cut demand for Russian gas by 7% this year, according to the IEA. Speeding up the replacement of gas boilers with heat pumps, which operate on electricity and are three times more efficient, could further cut that gas demand by 2% if combined with policies to rapidly increase the number of homes that get upgraded insulation.

The U.S. and Australia can together replace 70% of Europe’s Russian coal imports

Some politicians have already started to suggest that citizens will have to do their part to reduce energy consumption. “If you don’t want to act on going one degree lower for climate change, do it against Putin,” Claude Turmes, Luxembourg’s energy minister, said at an online panel last week. Similar techniques came into play during the 1973 Arab oil embargo and both world wars.

But it will take more than individual action. Policies related to Europe’s Green Deal, such as subsidies for heat pumps or mandates for retrofitting old buildings, will also need to be accelerated. In the most extreme scenario, countries may also have to turn to rationing. In the U.S. during the 1970s oil embargo, this took the form of allowing only cars with even-numbered license plates to fill up on fuel on even-numbered dates. Britons in the aftermath of WWII received fuel coupons depending on the needs of their profession, with doctors receiving more allowances.

“The imposition of rationing came as an understanding that you need to make sacrifices on the homefront, so that we can succeed on the battlefront,” says Meg Jacobs, a research scholar at Princeton University. It helps to “link sacrifices to the preservation of democracy.” That is exactly what Ukrainian President Volodymyr Zelenskiy has done.

Electrifying transportation more quickly might not help in the moment but can permanently reduce oil consumption in the longer term. Even without any additional policies, the clean-energy researchers at BloombergNEF expect electric vehicle sales in Europe to quadruple by 2030. If policymakers pour money into the industry in response to the Russian invasion, that rate could increase significantly. In Norway, for example, EV sales now make up 15% of the total thanks to strong incentives; the country’s oil demand has dropped by 10% from 2011 levels.

EU’s Quick Green Solutions

When it comes to fossil fuels, Europe is bound by the rules of the global energy market. But the clean-energy possibilities are more open. Prices of raw materials for solar panels and wind turbines are also rising, though nowhere near as much as the surge in fossil fuels. Plus, a clean-energy expansion dovetails with policies already in place. The EU planned to cut carbon emissions 55% by 2030, at a cost of 350 billion euros in energy infrastructure investment per year. That would be enough to reduce its overall gas consumption by 30%.

“The longer-term way out of this is to reduce our reliance on fossil fuels as quickly as possible,” says Michael Bradshaw, professor of global energy at University of Warwick.

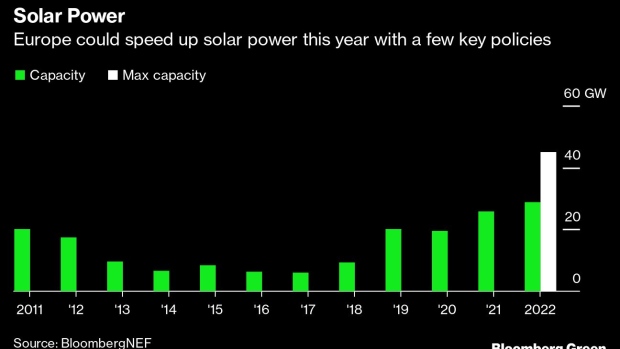

Of all the green solutions available, solar is the easiest to speed up. Panels are relatively easy to install, and rooftops all over Europe sit empty. The region could boost deployment by as much as 50% this year just by making approvals more efficient, according to Jenny Chase, head of solar analysis at BloombergNEF.

One key bottleneck is the way permits for bigger projects are allocated. In most European countries regulators grant permits for solar farms, then companies figure out how to get the power into the grid. But the process can be flipped so that grid operators map out where they have enough capacity to add large-scale projects, then solicit bids from developers. “Allocate sites where obviously they’re fine,” Chase says. “Build out more grid in places where you get a fair amount more bang for your buck.”

The U.S. and Australia can together replace 70% of Europe’s Russian coal imports

Speeding up permits, mandating that all new homes come with rooftop panels, and ensuring buildings that produce more solar can sell it back to the grid would be enough to prompt the installation of as much as 45 gigawatts of solar this year, according to estimates from BloombergNEF. That’s six years ahead of schedule based on its previous projections and would be enough electricity to power millions of homes.

Expanding wind power ahead of schedule will prove more difficult. It takes much longer to build turbines than solar panels because the gigantic blades must travel long distances. The industry already faces significant supply chain delays, says Gary Bills, regional director for Europe, Middle East and Africa at energy consultant K2 Management.

But reforming the European approach to wind permits can still make a difference in the longer term, according to Bills, by boosting deployment as much as 20%. Many areas of Italy still require developers to bring printed applications down to a local planning office, sometimes costing tens of thousands of euros for the paperwork alone. “They just need to be digitized somehow,” says Viktoriya Kerelska, head of advocacy at industry group Wind Europe.

Prioritizing major projects would help quickly add capacity. There’s nearly 19 gigawatts of wind power that’s been approved or under construction across Europe and the U.K. — roughly equal to the total installed wind power capacity of France. Finishing those projects would be enough to meet all of BloombergNEF’s expectations for additions this year. Adding even a minor fraction of the smaller wind farms that are furthest along in development would see Europe surpass BloombergNEF’s 2022 target.

If wind farms take up to two years to build, nuclear plants require at least a decade. The most immediate option would be prolonging Europe’s existing fleet, says Yves Desbazeille, director general of the Brussels nuclear industry association FORATOM. Extending the lives of three reactors set to shut by the end of 2022 could cut Germany’s total gas consumption by about 3% over the next two years, based on BloombergNEF projections.

Doing so would mark a rupture with Germany’s longstanding drive to eliminate its nuclear power. In recent weeks, as a result of the war in Ukraine, the German government briefly considered extending nuclear power’s life and possibly reactivating mothballed reactors. That process would entail sourcing uranium, a difficult task if the goal is to add nuclear capacity back before next winter, especially with Russia cut off as a potential source.

German plants slated for deactivation will technically retain their operating licenses beyond year-end but will probably need to pass some safety reviews by state regulators, according to Nicolas Wendler, a spokesman for the German nuclear industry group Kerntechnik Deutschland.

Long-Term Clean Energy Plays

Beyond short-term measures to ramp up zero-emission energy, Europe will also need to invest in new technologies if it wants to more rapidly abandon all fossil fuels as a way to eliminate Russia’s pull over the bloc. Both gas and coal continue to play a role in EU grids because they are crucial backups when the wind doesn’t blow and the sun doesn’t shine. As batteries have become cheaper, however, they are beginning to replace the need for fossil fuels by soaking up excess renewable electricity that can be released during peak demands.

The problem is that more than 80% of the world’s lithium-ion batteries made each year end up in electric cars rather than on grids. “Without a huge amount of growth in batteries on the grid, we just simply can't build enough renewables because the grid itself can't take it,” says Alex O’Cinneide, chief executive of London-based renewables investor Gore Street Capital. “Having more of our cell production going to energy storage rather than EVs, for the environment and for geopolitical reasons, is much more impactful.”

Europe lags behind places like California and Australia when it comes to grid batteries. But those examples show that operators can add a lot more storage if supported by government policies. Crucially, grid-scale batteries don’t have to only rely on lithium-ion technology. New and emerging ideas that use less expensive metals like iron could eventually make batteries even more attractive.

The U.S. and Australia can together replace 70% of Europe’s Russian coal imports

After the past year’s surge in the gas prices, hydrogen made from renewable energy has become cheaper than versions made with fossil fuel. As part of its climate agenda, the EU already planned to invest heavily in green hydrogen. Now it could go even further.

It takes as little as two years for project planning, manufacturing and construction, according to Meredith Annex, an analyst at BloombergNEF. The bigger challenge will be scaling up. By the end of this year, global manufacturers will be able to produce enough electrolyzers — devices that split water into hydrogen and oxygen atoms — to consume 13.5 gigawatts of clean electricity.

But that’s a fraction of what’s needed to replace Europe’s existing demand for hydrogen produced from natural gas. Making that much hydrogen would require 60 gigawatts of green power if the machines were running all the time — and more than 200 gigawatts in a more realistic scenario where the electricity comes from solar or onshore-wind farms, according to BloombergNEF.

Producing more renewable energy isn’t the same as getting it where it’s most needed. If Europe speeds up major renewable energy projects, it will also need more giant cables to move the power around. Those structures will help take the abundant wind resource from Northern Europe down to the cities farther south. By the end of the decade, cables could stretch across the Mediterranean Sea to bring solar power from Tunisia and Egypt to Italy and Greece.

There aren’t many good options for speeding up these improvements to the grid. All the current manufacturing capacity for large cables is already spoken for, says Christopher Guerin, chief executive of French cable maker Nexans SA. It can take at least two years to increase manufacturing capacity and up to three years to build a major cable project, such as crossing the North Sea.

The cable business, like batteries, is also reliant on metals like copper that are in limited supply globally. Still, with clear mandates from the government on projects and planning, the industry could make investments now that will enable faster deployment in the latter half of the decade.

“Nothing is impossible,” Guerin said. “It’s all a matter of time and investment.”

©2022 Bloomberg L.P.