Jun 30, 2022

Europe Junk Credit Gauge Above 600 for First Time Since 2020

, Bloomberg News

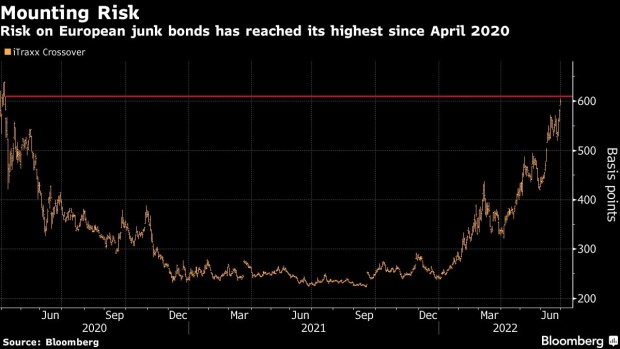

(Bloomberg) -- A gauge measuring risk on European junk bonds crossed the threshold of 600 basis points for the first time since April 2020, as central bankers reiterated concerns over inflation.

The iTraxx Crossover, which tracks the cost of insuring European high yield bonds, jumped to as much as 605 basis points on Wednesday, reaching its highest level since April 2020, according to CBBT pricing compiled by Bloomberg. The move came after central bankers meeting in Portugal contemplated the new policy play-book which might be required in a new world of surging prices.

Junk credit has struggled in this first half of the year, as mounting recession fears dampened the risk appetite of investors and pushed them to seek shelter in safer asset classes. A Bloomberg index tracking returns for high yield bonds saw a 13.6% decline year-to-date.

Investors have been pulling out their money in bulk away from European-domiciled funds with a focus on junk bonds: outflows in 2022 through to June 22 have amounted to $27.7 billion, according to EPFR Global data cited by Bank of America analysts.

The index has climbed fast over the month of June: it had crossed the threshold of 500 basis points just 20 days ago.

(adds chart and outflows data in fourth graph.)

©2022 Bloomberg L.P.