Mar 3, 2022

Europe’s Biggest Port Is Very Worried About Russian War Impact

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Europe’s biggest port is where the sharp end of sanctions against Russia looks likely to hurt the Netherlands, even if the nation’s economic statistics might suggest otherwise.

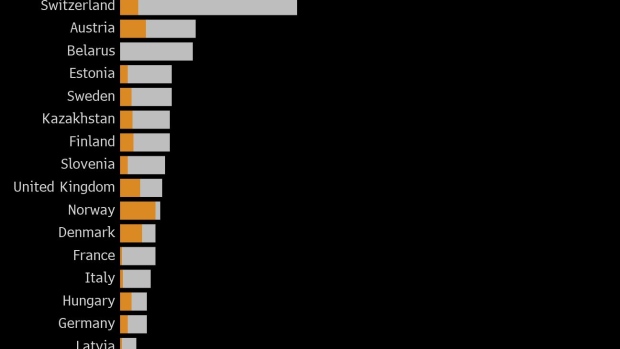

Measured by foreign direct investments plowed into that country, the Dutch stand out as by far the most exposed among economies listed by the International Monetary Fund. But such data are distorted by factors such as Rotterdam’s out-sized role as the premier hub for European trade.

Analysts point to the harbor business and agriculture as the Netherlands’ most vulnerable sectors to the crisis sparked by Russia’s invasion of Ukraine, and subsequent sanctions. That reflects its position as a bellwether of global growth along with its ranking as the euro region’s fifth-biggest economy.

“A stable economic world order is essential to the Netherlands,” said Ester Barendregt, chief economist of Rabobank.

Sandra Phlippen, chief economist at ABN Amro, highlights the harbor business as a particularly sensitive economic pillar of the Netherlands. “The Port of Rotterdam could be hit hard, because they do a lot of re-exporting,” she said.

A total of 62 million tons in cargo handled there -- 15% of the overall volume -- is related to Russia. Of the total number of containers passing through, 10% are linked to the country, which also exports steel, copper, aluminum and nickel via that hub.

Sanctions on Russia will lead to bottlenecks and hit annual trade of products and goods valued at about 30 billion euros ($33 billion), Allard Castelein, chief executive officer of the Port of Rotterdam, told reporters last week.

“We are extremely worried,” he said. “If there is an acute energy crisis, the port will be hit.”

The farming industry faces related challenges, according to the Rabobank and ABN Amro economists.

Fruit and Vegetables

“Products like flowers, vegetables or fruits are hit via two channels: they are important export products to Russia and are energy intensive,” Barendregt said.

For Farmers NV, a Netherlands-based animal feed producer, began ringing alarm bells just as the Russian invasion began.

“We expect raw material and energy prices to remain high, given the worrying political situation,” CEO Yoram Knoop wrote in an annual report last Thursday. “We therefore expect continued pressure on margin and costs during 2022.”

Overall, the direct trade impact of Russian sanctions is likely to be limited, as exports to Russia account for 1.1% of the Netherlands’ overseas sales.

As for data pointing to its foreign investment in Russia totaling more than 10% of the Dutch economy, ABN’s Phlippen says it really mostly reflects goods passing through Rotterdam and transactions via so-called letterbox companies, based in the Netherlands perhaps for tax reasons.

“These flows do not add much value ,” she said. “Their impact on our economy will thus be limited.”

©2022 Bloomberg L.P.