Aug 9, 2022

Europe’s Bond Market Has Never Seen So Many Days With No Deals

, Bloomberg News

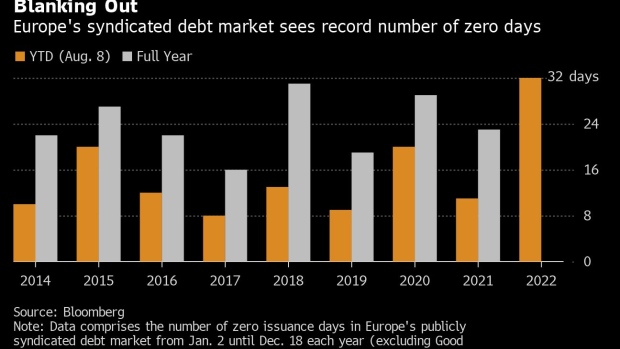

(Bloomberg) -- Europe’s bond market is enduring its worst drought in at least 8 years.

The market has seen 32 days without a single public debt offering from governments and corporations this year, already surpassing 2018 as the slowest year since records begin in 2014, according to data compiled by Bloomberg. That tally is certain to rise since activity usually slows markedly during the August vacation season.

The steep drop in borrowing reflects uncertainty facing the European economy as rising interest rates, surging inflation and the possibility that Russia could cut off natural gas supplies this winter raise the risks of a recession. That’s made businesses in particular hesitant to run up new debts and driven investors to pull billions from corporate-bond funds as the securities suffer the largest losses since 2008, according to Bloomberg’s Pan-European corporate debt index.

Firms Brave Enough to Sell Bonds Are Rewarded With Lower Costs

Last week, there were only 2.6 billion euros ($2.65 billion) of primary-market deals in Europe, the lowest so far this year, and year-to-date volumes are down over 22% from 2021, the data shows.

When looking at non-financial corporate-bond sales the slowdown is even more severe, with 79 zero days so far this year.

©2022 Bloomberg L.P.