Jan 13, 2022

Europe's Bond Sales Just Set a New Record

, Bloomberg News

(Bloomberg) -- Europe’s debt market is breaking records with $107 billion of sales in a single week as borrowers rush to get ahead of rising interest rates.

Portugal, Spain and discount airline Wizz Air have all raised funding this week. The tally beats a previous record set in early 2020, when firms loaded up on cash just before the pandemic took hold.

The sales boom follows an earlier-than-normal close for the market in the lead-up to Christmas, while the European Central Bank is set to start winding down bond purchases. Rate hikes are also coming in the U.S. after the biggest surge in U.S. consumer prices in nearly four decades last year.

“There is a bit more nervousness about how much spreads and yields may widen due to the Fed and the overall inflation picture,” said Marco Baldini, head of EMEA and Japan bond syndicate at Barclays Plc. “That is definitely spurring issuers to go for a deal before they go into blackout, when in other years they may have done nothing.”

Going Large

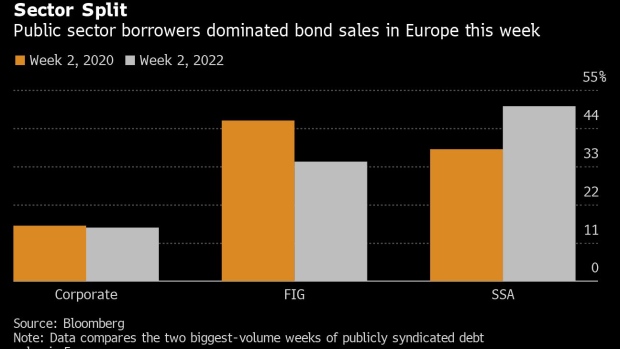

Jumbo-sized deals from supranational and sovereign issuers like Spain, French agency CADES and the European Financial Stability Facility have helped fuel the market’s fast start to the year. Investors are piling in too: EFSF pulled in 30 billion euros ($34 billion) of bids for its two-part 5.5 billion euros deal, while CADES booked over 26.5 billion euros of orders for its 6 billion-euro sale.

“With the purchase program coming to an end, issuers are taking advantage of very robust funding conditions,” said Neal Ganatra, Deutsche Bank AG’s EMEA head of debt capital markets, SSA syndicate. “When we look at the names that have come to the market, they are very much the traditional frequent issuers.”

The corporate market is also seeing its share of big deals, as firms seize on Europe’s still relatively low borrowing costs as the year’s first raft of corporate earnings and subsequent quiet period approaches. Enel SpA, Prosus NV and E.On SE all raised at least 1 billion euros apiece. That’s helped push non-SSA sales ahead of the U.S. market, where high-grade issuance had reached $36 billion as of Wednesday’s close, according to data compiled by Bloomberg.

To be sure, borrowing is in line the highest predictions in a Bloomberg News survey conducted on Jan. 7, in which 39% of respondents said they expected weekly sales to exceed 50 billion euros. January is traditionally one of the busiest months of the year for publicly syndicated debt issuance.

“We are seeing an abundance of supply because this is the first full week of the year, when everyone is back at their desks,” said Deutsche Bank’s Ganatra. “Last week, with the holidays, execution windows were very tight.”

Still, he said, “executing a transaction is no longer as straightforward as it was last year.”

Elsewhere in credit markets:

EMEA

Nineteen issuers are offering 21 tranches on Europe’s primary market on Thursday.

- A real estate firm decided to swallow the cost of an early call of a bond maturing later this year; there are billions of euros of debt with a similar feature

- In the high-yield space, agricultural conglomerate Tereos upsized its bond to 350 million euros from 300 million while also offering a lower yield, suggesting strong investor demand

- Software firms Micro Focus and Iris Software are due to price the first loans of the year, offering an indication on price trends

Asia

Chinese real estate developers extended declines on signs that debt stress is growing in the embattled sector, with Country Garden Holdings Co. reportedly unable to find demand for a $300 million convertible bond.

- Several of China’s largest banks have become more selective about funding real estate projects by local government financing vehicles, concerned that some are taking on too much risk after they replaced private developers as key buyers of land, people familiar with the matter said

- Junk-rated Chinese developers that are closer to investment grade than many peers had some of Thursday’s biggest declines in dollar bond prices, as selling continued to broaden beyond weaker names

Americas

Money managers who buy U.S. junk bonds instead of high-grade debt are getting the smallest compensation for taking that risk since before the pandemic.

- Risk premiums on the highest tier of junk bonds were just 0.72 percentage point more than for the lowest levels of investment-grade corporate bonds at the end of December, according to data compiled by Bloomberg

- Elsewhere, the high-grade CDX benchmark rallied Wednesday after a report that showed the fastest inflation in about four decades was roughly in line with market expectations

(Updates with charts, regional sections)

©2022 Bloomberg L.P.