Jun 23, 2021

Europe's economy is booming as nations cast off crisis shackles

, Bloomberg News

U.K. Government Business Support Needs to Continue, Says CBI's Bilimoria

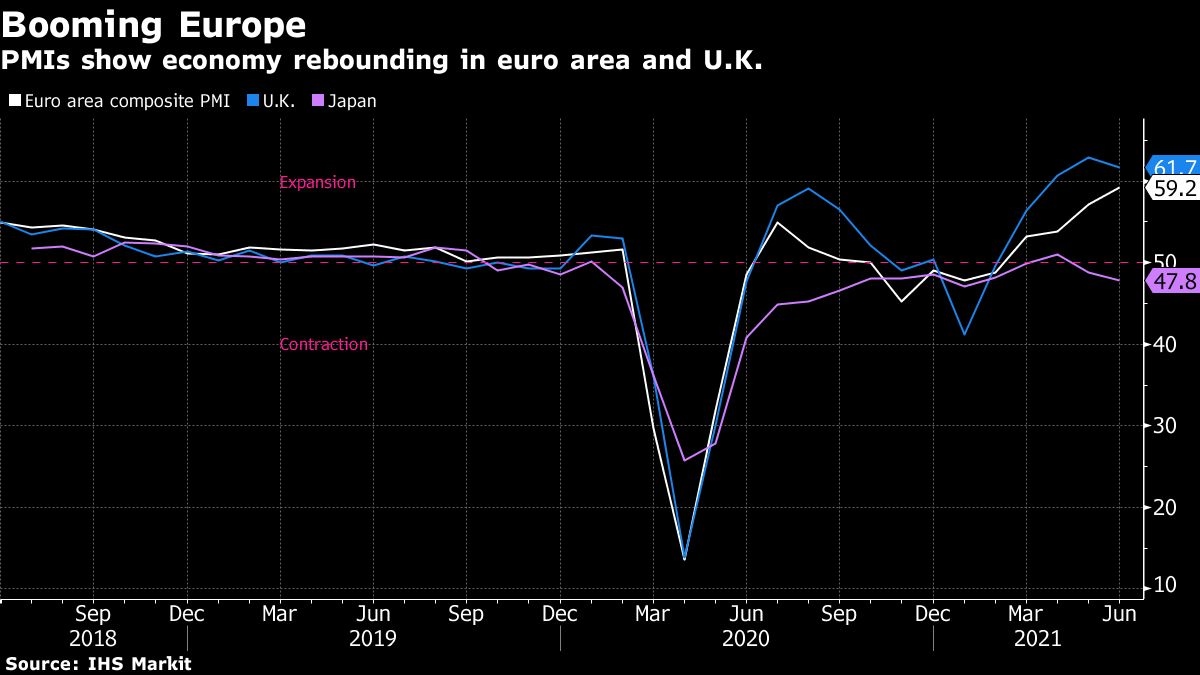

Europe’s private-sector economy is booming, accompanied by mounting inflation pressures as coronavirus restrictions loosen across the region.

Surveys of purchasing managers by IHS Markit showed euro-area activity growing at the fastest pace in 15 years, with companies struggling to keep up with demand and prices surging. The equivalent U.K. index was only slightly below May’s record, with firms hiring staff quicker than at any time since it began collecting data in 1998.

A global rebound from the coronavirus crisis is spreading through the region as the receding pandemic allows consumer-facing sectors to resume business. European Central Bank President Christine Lagarde acknowledged the pickup this week, saying the outlook "is indeed brightening" while insisting inflation pressures are purely temporary.

"Europe is recovering fast," Holger Schmieding, chief economist at Berenberg in London, said in a report. "The euro zone is following the U.K. which, from a lower base, started to bounce back in March after getting the pandemic under control with harsh lockdowns and a rapid vaccination campaign."

In the U.S., a measure of manufacturing activity expanded in June at the fastest pace in records dating back to 2007 -- fueled by easing pandemic restrictions and a strengthening domestic economy. Service providers also registered continued growth in costs and prices charged, providing further evidence of the inflationary pressures building across the economy.

In contrast, a similar survey in Japan showed private-sector activity contracting, led by services. Some business restrictions remain in place there to prevent flareups of the virus as the nation prepares for the Tokyo summer Olympics next month.

The euro-zone indexes showed buoyancy across the board. Confidence in the economic outlook reached the highest since sentiment data were first recorded in 2012 after slowing infection rates allowed services including bars and restaurants to reopen.

What Bloomberg Economics Says...

"With the deployment of the vaccines accelerating, we expect a gradual reopening of the economy, led by hospitality and non-essential retail stores, from May to help euro-area GDP expand by 1.2% in 2Q."

-David Powell.

An uptick in services was especially pronounced in Germany, the region’s largest economy. Manufacturers there also saw the first signs that the worst of a supply squeeze may be over, with a fall in reports of longer lead times and rising materials prices.

Average prices charged for goods and services in the euro area rose at by far the fastest pace since comparable data for both sectors were first available in 2002. Warehouses are increasingly depleted, and staffing pressures remain high, auguring further upward pressure on inflation in coming months.

In the U.K., there was also evidence that labor shortages are pushing up wage costs, suggesting the recent spike in inflation above the Bank of England’s 2% target could prove "stickier" than initially hoped. That could embolden outgoing Chief Economist Andy Haldane to reiterate his call for a dial-down in stimulus at Thursday’s decision.

Some ECB officials have warned of upside risks to outlook for consumer prices, though Lagarde earlier this week repeated the view that the pressure will be temporary, insisting also that spillovers from the U.S. will be moderate. The central bank decided this month to continue its elevated pace of monetary stimulus.

Vice President Luis de Guindos echoed Lagarde’s line on Wednesday, while acknowledging that the euro area is likely to see "very significant" economic growth in the second half of the year.

"The data set the scene for an impressive expansion of gross domestic product in the second quarter to be followed by even stronger growth in the third quarter," said IHS Markit Chief Business Economist Chris Williamson. "However, the strength of the upturn -- both within Europe and globally -- means firms are struggling to meet demand."

--With assistance from Carolynn Look, Jeannette Neumann, Zoe Schneeweiss and Alex Tanzi.