Sep 21, 2021

Europe’s ESG Bond Deals Surge to Record 25% of Sales

, Bloomberg News

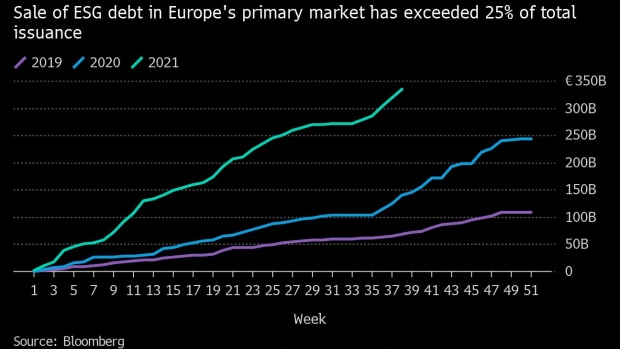

(Bloomberg) -- Europe’s market for virtuous debt has reached a new milestone: ethical bonds now account for a quarter of all debt sales.

Corporates and sovereigns have sold more than 333 billion euros ($391 billion) in debt with environmental, social or governance goals this year. The deals account for about 25% of all sales in Europe, almost double the proportion from last year and an all-time high.

“Investors in Europe have become ESG investors,” said Helene Jolly, head of EMEA investment-grade corporate syndicate at Deutsche Bank AG. “Investors look at the ESG credentials of every piece of paper that they buy.”

Deals in the market are booming, with the U.K.’s debut breaking records for a green bond sale and companies such as Italian utility Enel SpA swapping out its conventional debt for bonds linked to environmental targets. It’s all part of a push to reach climate targets as the executives and politicians race to put Europe at the forefront of tackling climate change.

Ethical Debt Glossary: ESG, SLB, SLL, KPIs and More: QuickTake

Investors have been so eager to buy ESG bonds that they’ve been willing to sacrifice a little bit of return in exchange. In the U.K., pricing suggests that the country achieved slightly cheaper borrowing costs relative to conventional debt -- known as a greenium -- of around two basis points, according to RBC Europe Limited strategist Megum Muhic.

“There is clearly broad-based demand,” said Aaron Rock, a fund manager at Aberdeen Standard. “We view it as another vote of confidence for the ESG bond market.”

(Adds quote and context throughout)

©2021 Bloomberg L.P.