Jul 11, 2020

Europe Set to Give ‘Wake-Up Call’ to Bonds Stuck in Summer Lull

, Bloomberg News

(Bloomberg) -- With the European Central Bank setting monetary policy, the U.K. revealing more of its borrowing plans and a European Union summit coming up, the calm in bond markets may be disturbed.

While the ECB is expected to hold interest rates and asset purchases steady Thursday, it could still tweak rules on cash deposits to help lenders cope with the pain of negative interest rates. And Citigroup Inc. rates strategist Jamie Searle sees the U.K. Treasury announce plans to sell 110 billion pounds of bonds from September to November.

A summit of European leaders begins a day later, with officials attempting to thrash out an agreement on a regional recovery fund. Progress on a deal, after opposition from some states opposed to grants for more indebted members of the bloc, could spur a relief rally in Italian bonds and add fuel to recent gains in the euro.

“Next week’s ECB meeting and EU summit could be a wake-up call for complacent bond markets,” wrote Christoph Rieger, head of fixed-rate strategy at Commerzbank AG.

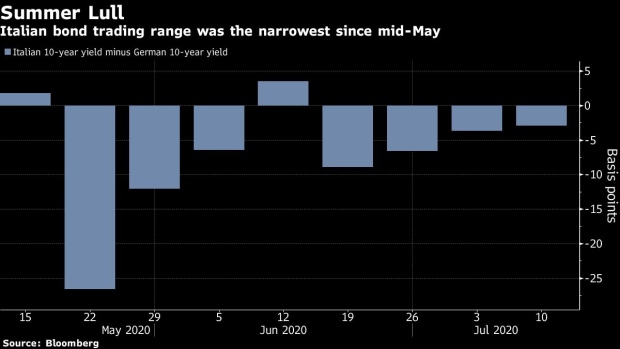

Markets have already showed signs of winding down for the summer. Trading in Italy’s bonds, among the most liquid and volatile in the euro area, were stuck in the narrowest range last week since mid-May.

What Bloomberg Intelligence says:

“Low volumes on bund futures and lack of conviction have set in. Implied volatility has been crushed, allowing summer hedges at low cost.”

-- Tanvir Sandhu, Chief Global Derivatives Strategist

Bond Sales

Euro-area bond sales are scheduled from Germany, France, Spain, Netherlands and Italy, which will sell a new seven-year note. Total sales are expected of around 36 billion euros for the week, according to Commerzbank AG. Netherlands and Austria will pay around 30 billion euros of redemptions and almost 4 billion euros of coupon payments next week.

The U.K. will hold four regular gilt auctions for a combined 11 billion pounds and buy back bonds at a steady rate of 1.5 billion pounds per operation.

- Data for the coming week in the euro area and Germany is mostly relegated to second-tier, backward-looking figures, with the exception of German ZEW survey figures for July

- The U.K. data slate picks up with June inflation, monthly GDP for May and May unemployment numbers

- With Chancellor of the Exchequer Rishi Sunak promising this month to spend another 30 billion pounds to prop up the economy, investors will be keen to see how many gilts will be sold to fund this

- A quiet period ahead of Thursday’s ECB rate decision means there are no speakers scheduled until President Christine Lagarde’s press conference after the outcome

- For the BOE, Governor Andrew Bailey has a busy schedule, speaking three times next week. Investors will be looking for clues on the direction of interest rates after easing bets rose this week; Andrew Haldane and Silvana Tenreyro are also slated to speak

- Moody’s Investors Service reviews Portugal’s Baa3 rating Friday

©2020 Bloomberg L.P.