Mar 4, 2022

Europe Stocks See Biggest Ever Weekly Outflow as War Intensifies

, Bloomberg News

(Bloomberg) -- The escalation of the war in Ukraine is pushing investors to exit European stocks like never before amid rising inflation risks, according to Bank of America Corp. strategists.

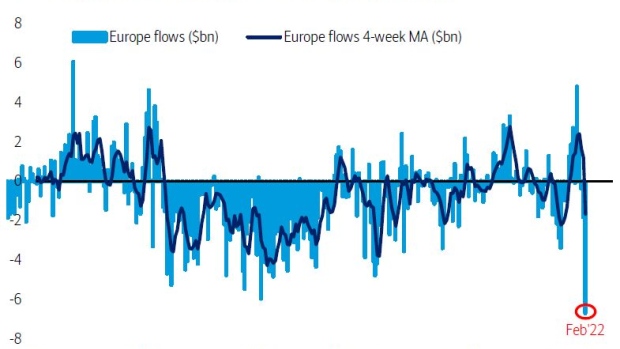

European equities had their largest outflows on record at $6.7 billion in the week to March 2, the strategists wrote, citing EPFR Global data. The redemptions from the region caused the first outflow in 10 weeks for global stocks to the tune of $5 billion.

“Financial market accidents threaten global recession,” strategists led by Michael Hartnett wrote in a note. The war in Ukraine implies a bigger “inflation shock” as commodity prices surge, and investors should be “maximum defensive” in the absence of de-escalation, they said.

The record outflows from Europe come as the war adds to concerns about slowing growth and soaring inflation. Some of the region’s stocks are heavily exposed to Russia, while European countries are highly dependent on commodity imports from Russia and Ukraine. The Stoxx Europe 600 index has fallen about 13% from its January record, more than the S&P 500’s 9% drop from its closing peak.

Investors also sought to exit global financial stocks, which also had their largest weekly outflows on record, while materials and energy, two sectors positively linked to commodity inflation, had significant inflows, the data showed. European financials, which were one of the main beneficiaries of the recovery, have plummeted more than 20% since a peak on Feb. 10, while global financials are down 10%.

“War is stagflationary,” Hartnett said, comparing the current situation with the Yom Kippur War and the oil shock of 1973. Back then, the S&P 500 dropped about 40% from peak-to-trough, and only commodities outperformed inflation, he said.

Stagflationary Shock May Be Next for Plunging Stock Markets

Investors went to hide in cash and gold, with money market funds attracting $46.3 billion, their largest inflow in nine weeks, while $1.9 billion went to gold.

©2022 Bloomberg L.P.