Apr 26, 2019

Europe Stops Taking Piped Russian Oil Because of Contamination

, Bloomberg News

(Bloomberg) -- Europe’s oil refineries stopped taking piped deliveries of Urals crude from Russia after flows were found to be contaminated, choking off one of the continent’s main sources of supply.

Pumping through a section of the Druzhba pipeline into southern and central Europe was halted overnight, Ukraine said. That brings the link to a complete stop after a larger, northern spur into Poland and Germany had already ceased. It means a temporary loss of at least 1 million barrels a day of crude with more barrels still at risk.

The halt comes at a critical time for a global oil market that’s been hit by restricted supplies of so-called heavier crudes from the likes of Iran, Venezuela, Canada and even Mexico. That’s on top of a pact by producers including Saudi Arabia and Russia to collectively limit production that’s seen prices steadily rising for several months.

“It is bullish for the market, and also for crude differentials,” said PVM Oil Associates Ltd. analyst Tamas Varga. “The Urals market has been quite bullish relative to Brent and now it’s more so.”

The piped oil has become tainted by organic chlorides that, when refined, become hydrochloric acid that can damage the plants. The issue, first raised by Belarus last week, has also affected supplies from the Russian port of Ust-Luga in the Baltic Sea, according to a person familiar with the matter. There are no signs that shipments from Novorossiysk or Primorsk, two other Russian tanker-loading facilities, have been disrupted.

Brent crude passed $75 a barrel for the first time since October on Thursday. It was trading at $74.18 at 7:46 a.m. in London.

Short Supply

Organic chlorides are not naturally occurring and are used in upstream processes to boost output, “but must be removed before bringing crude parcels to market,” said Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd.

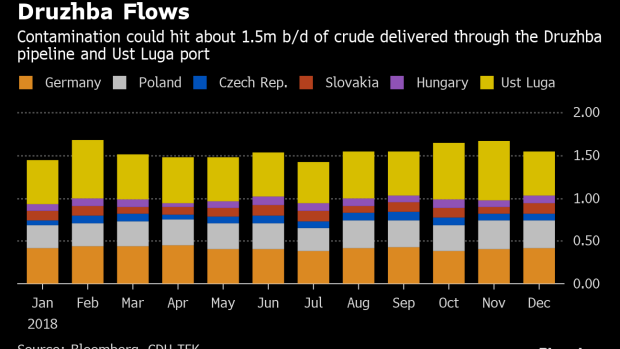

The northern part of the pipeline delivered about 730,000 barrels a day of crude to Germany and Poland in the final five months of last year, Russian Energy Ministry data show. As much as 1.5 million barrels a day are at risk, according to data compiled by Bloomberg. That equates to about a tenth of Europe’s entire consumption -- and more for the countries directly affected.

Ukrainian state-run Ukrtransnafta said on Facebook that it “was forced” to halt transit of Russian oil to the European Union via the southern link because the crude didn’t meet quality requirements. Slovakia also refused to accept the oil for the same reasons.

Mol Nyrt., which has refineries in Hungary and Slovakia, had said earlier that it was monitoring crude as it flowed through the southern section of the pipeline and that the oil it had observed met the company’s required operation standards. It takes several days for Russian oil to flow through the pipeline to the two countries.

In a sign that oil traders are scrambling for replacement barrels, the premium for Brent crude for immediate delivery over supplies in six months time surged to as much as $3.25 a barrel on Thursday, the widest spread in about five years.

Belarus, which sits between Russia and Poland, complained late last week that its refineries could suffer damage from the contamination. Poland’s biggest refiners, Grupa Lotos SA and PKN Orlen SA, said Thursday their productivity won’t be affected.

The Druzhba pipeline divides in Belarus, with the southern section supplying refineries in countries including the Czech Republic, Slovakia and Hungary.

Technical Issues

Supplies of oil and refined products to the Polish market will be maintained from stockpiles until the situation is resolved, according to PERN, the pipeline operator. If the halt is prolonged, the refiners will import crude through the Gdansk port on the Baltic Sea, it said.

PKN Orlen said it anticipates the halt lasting one or two weeks. Issues with the quality of Russian crude supply are “technical” and should be resolved in “near future,” Russian Deputy Prime Minister Dmitry Kozak said Thursday.

Belarus told PERN about problems with the oil quality on April 19 and halted its exports of refined fuel. The country, which profits from processing Russian crude, is embroiled in a fight with its larger neighbor over an energy tax regime that it says could deprive its budget of billions of dollars.

Seaborne Option

Amid friction over Russia’s push for deeper economic and political integration, Belarusian President Alexander Lukashenko threatened earlier this month to close pipelines transporting Russian oil across his country for maintenance. Russia has said it may increase oil exports via sea if the Druzhba pipeline closes.

A spokesman for Russian pipeline operator Transneft PJSC didn’t immediately respond to a request for comment.

“There has been no improvement in the quality of Russian crude, it still does not correspond to the norms,” Marina Kostiuchenko, a spokeswoman for Belarusian state petrochemicals company Belneftekhim said by phone from Minsk on Thursday. "Acceptable quality norms are exceeded several times, the situation has not improved."

--With assistance from Jake Rudnitsky, Javier Blas, Julian Lee, Sherry Su and Alex Longley.

To contact the reporters on this story: Aliaksandr Kudrytski in Minsk, Belarus at akudrytski@bloomberg.net;Maciej Martewicz in Warsaw at mmartewicz@bloomberg.net

To contact the editors responsible for this story: Alaric Nightingale at anightingal1@bloomberg.net, ;Torrey Clark at tclark8@bloomberg.net, John Deane

©2019 Bloomberg L.P.