Mar 31, 2023

European Airlines Are Set for a Good Summer on Strong Demand

, Bloomberg News

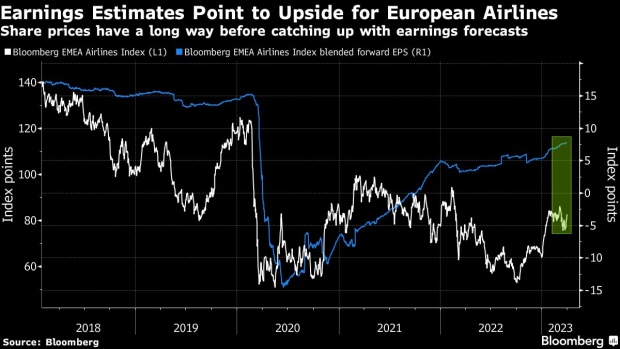

(Bloomberg) -- The summer travel season is shaping up to be a good one for European airlines, prompting Deutsche Bank AG and Barclays Plc to upgrade several carriers that could benefit from rising fares, strong demand and lower jet fuel prices.

Air travel took a hit during the coronavirus pandemic, as lockdowns, travel bans and capacity restraints at airports weighed on earnings. Now, more and more European carriers are predicting a rebound in travel this summer, with Deutsche Lufthansa AG recently joining the chorus of carriers expecting an earnings boost. European airlines could see a quicker recovery in profit this year than previously thought, Deutsche Bank said.

Even with conservative assumptions on yields, fuel prices and non-fuel costs, analysts Jaime Rowbotham and Andy Chu nonetheless see potential for operating profits in 2023 to be more than 20% higher than previously thought. The positive momentum is “hard to ignore,” they wrote in a note Friday upgrading Air France-KLM SA, British Airways owner International Consolidated Airlines Group SA and Lufthansa to buy from hold.

Shares in all three airlines rose on Friday, with the Stoxx 600 Travel & Leisure sub-index climbing to its highest level since March 8.

The magnitude of their upgrades to 2023 estimates, which would imply lower indebtedness for airlines, could provide catalysts for further share price appreciation in the coming months, with 45% upside on average, Rowbotham and Chu wrote. Their preferred pick is Lufthansa, with a price target of €14.50 implying upside of about 50%.

In a separate note, Barclays said it expects travel demand to stay strong despite macro concerns, while airlines will benefit from lower fuel prices and a weaker dollar. While European airlines are expected to report losses for the first quarter, those would be “significantly reduced” relative to the Covid-affected year-earlier period, analysts led by Andrew Lobbenberg wrote in a note.

“Moreover, we expect bookings and pricing into the summer to remain very constructive,” the analysts wrote. They upgraded their recommendations on EasyJet Plc and IAG to overweight from equal-weight, expecting “confident trading commentary” from both airlines on March-quarter results.

--With assistance from Sam Unsted and Michael Msika.

©2023 Bloomberg L.P.