Feb 3, 2023

European Banks Are Profiting Like It’s 2007. How Long Can It Last?

, Bloomberg News

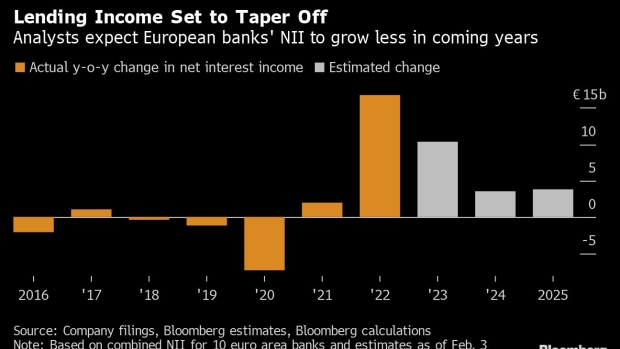

(Bloomberg) -- European banks are reveling in their highest profits since before the financial crisis, benefiting from an unprecedented rate of rate increases that’s driving a surge in lending income. The question is how long it can last.

Ten of the region’s biggest lenders that have reported so far boosted net lending revenue by 16% to a record €120.8 billion ($131.6 billion) last year, fueling their highest profits since 2007 and setting off a cascade of dividend increases and buybacks. With rates set to increase further, executives from Deutsche Bank AG to Nordea Bank Abp are saying the good times aren’t over yet. But savers look set to start demanding their cut of the higher rates.

At first glance, European banks are in a Goldilocks moment: tighter monetary policy aimed at cutting inflation is letting them charge more for credit, while at the same time they’re passing on only a fraction of the increases to depositors. The difference between the two is known as net interest income, and it’s surging. Yet at the same time, higher rates compound the squeeze on corporate and retail clients. Inflation is still through the roof and recession fears are not yet in the rearview mirror.

That raises the prospect of higher defaults and a pullback by hard-up borrowers, both of which could hurt bank’s balance sheets in the future.

“After many years of shrinking revenues, the banks have turned into a growth story,” said Francois Lavier, who helps manage €35.9 billion including bank bonds at Lazard Freres Gestion in Paris. “That should continue in the euro area this year, but repricing can’t go on forever. If rates peak, the revenue increases will stop as the repricing comes to an end or we see another negative impact like more expensive deposits.”

The Federal Reserve, which started raising rates earlier than the European Central Bank, shows that banks won’t be able to rely on monetary policy helping drive earnings forever. The Fed is slowing rate hikes and swaps are even pricing in cuts by year end.

“The interest income really came through,” Ralph Hamers, chief executive officer of UBS Group AG, said in an interview with Bloomberg TV’s Manus Cranny on Tuesday. “On the dollar effect, we feel it has most likely peaked, however there is more to come on the euro and the Swiss franc.”

In contrast, the ECB lifted interest rates by a half-point on Thursday and pledged another such move next month before officials then take stock of where borrowing costs must go to tame inflation.

Eastern Europe also shows the benefit to lenders will eventually ebb. Several central banks there are expected to cut borrowing costs later this year and depositors in some countries are already looking for better interest rates.

Raiffeisen Bank International AG said on Wednesday that its net interest income in the Czech Republic took an €8 million hit in the fourth quarter after having to pay higher interest to its clients as they moved money from current accounts to higher-yielding savings accounts at the bank.

That dynamic “explains why we’re not so enthusiastic anymore of a further increase in NII,” Johann Strobl, the Austrian bank’s CEO, told analysts, when asked about the Czech market.

Deutsche Bank signaled on Thursday that the bump to earnings from higher interest rates may be less pronounced in future years, partly because it will have to pay more to depositors. For now though, the German lender is “traveling well below” its previous assumptions of how much money it would need to pass on to clients, according to Chief Financial Officer James von Moltke.

While European lenders may not pass on much of the gains straight away, they can also point to the precedent of initially shielding savers when the ECB took rates negative in 2014, with many ultimately only charging for money held with the bank at certain thresholds such as €100,000.

“So far, the rising rates by the ECB have been sharper than the rising rates in terms of deposits,” Tanate Phutrakul, the CFO of ING Groep NV, said in an interview with Bloomberg TV’s Tom Mackenzie on Thursday. The Dutch lender isn’t having difficulty attracting such funding after it took in about €10 billion of retail deposits in the quarter, yet it will continue to watch competitors closely, he said.

The other side of the equation is the risk of demand destruction if clients decide taking a loan is too expensive, curbing a bread and butter part of corporate and retail banking.

Lenders saw demand for corporate loans fall 11% in the fourth quarter while that for residential mortgages slumped by a record 74%, according to the ECB. Banks expect demand from companies and households to decline further in the first three months of this year, according to an ECB survey released last month.

Housing markets and home loan demand globally are sagging under the weight and speed of the central bank rate rises. Spain’s Banco Bilbao Vizcaya Argentaria SA expects “slightly negative” growth in mortgages in its home country this year, CEO Onur Genc told analysts on Wednesday. The bank is relying on higher demand for consumer and corporate loans, notably from companies’ needs for working capital, to make up for that, he said.

Banks, so far at least, have managed to avoid an increase in the share of bad loans on their balance sheets. Several, though, are setting aside funds to cover loans going sour during a possible downturn. Genc acknowledged the risk that inflation and rates have a knock-on effect on non-performing loan levels. While BBVA has built buffers, it also expects loan loss provisions to come in at about 1% of loans this year, compared with 0.91% in 2022, he said.

Still, the Spanish lender said it stands to boost revenue at a much higher rate. Other bankers are also sanguine that the boost from rates will increase their profits this year despite turmoil elsewhere.

“Our 2022 results have been a record, with a very different year than was expected,” Ana Botin, the executive chairman of Banco Santander SA, said in an interview with Bloomberg TV on Thursday. “It’s still difficult for the economy, it’s not clear what’s going to happen but we feel confident with the guidance we’ve given.”

©2023 Bloomberg L.P.