Mar 31, 2023

European Gas Heads for Weekly Gain With Focus on Demand Recovery

, Bloomberg News

(Bloomberg) -- European natural gas prices extended their weekly gain, with traders weighing forecasts for colder weather and supply risks against healthy fuel stockpiles.

Benchmark futures jumped on Friday, climbing about 14% for the week, as heating demand is expected to drag on for longer with forecast temperatures below normal for much of the continent at the start of April.

Read More: Freezing Spring Weather in Europe to Boost Heating Demand

That, together with a combination of supply risks — from some French nuclear maintenance extensions to delays at the Calcasieu Pass export facility in the US — pushed prices higher, according to James Waddell, head of European gas at consultant Energy Aspects Ltd.

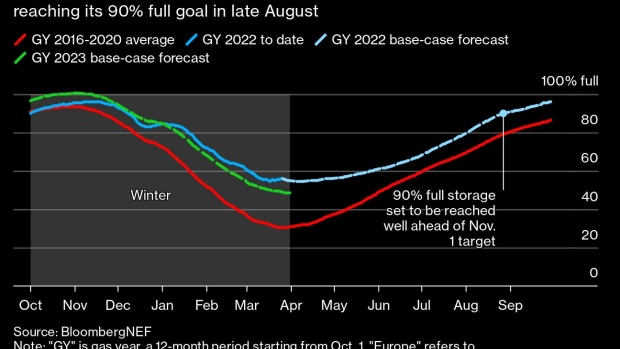

Concerns about supply availability are back in focus even as Europe’s gas storage levels — about 56% as of March 29, the latest data — are the fullest for the time of year in more than a decade. The region is on track to refill its stockpiles well ahead of the next heating season, according to BloombergNEF.

Traders are watching for anything that could tip the frail market balance as global supplies remain tight.

Dutch front-month gas futures for delivery in May jumped as much as 10% and traded at €46.53 a megawatt-hour by 3:45 p.m. in Amsterdam, touching the highest in more than two weeks. The UK equivalent contract rose 6.6%. Month-ahead power contracts in France and Germany also advanced.

Gains in coal and oil prices since last week have also provided “a higher support level for the gas market,” according to Waddell.

Competition between the fuels intensified after gas prices slid to the lowest levels since July 2021 earlier this month. Gas has become more attractive again compared with coal and oil products for some power plants and industrial users. There’s also emerging appetite for liquefied natural gas in parts of Asia.

Some industry watchers, including Goldman Sachs Group Inc. and Vitol Group, have warned gas prices may more than double from current levels on demand recovery.

“Prices seem to be searching for the floor” and will probably rise further later this year, said Kateryna Filippenko, director for global gas research at Wood Mackenzie Ltd. “We will unlikely see the levels of 2022 but the volatility is here to stay,” she said at the European Gas Conference in Vienna this week.

©2023 Bloomberg L.P.