Nov 3, 2022

European Gas Prices Advance With Focus on Weather, Tight Supply

, Bloomberg News

(Bloomberg) -- European natural gas steadied, with traders focusing on weather forecasts, while some fuel cargoes are starting to divert away from the region.

Benchmark futures settled 0.3% lower after surging as much as 10% earlier. The recent warmth, strong imports of liquefied natural gas and fuller-than-normal gas stockpiles have given Europe a much-needed reprieve from the energy crisis with prices losing more than 60% from August peaks.

Yet, it also forced some LNG traders, waiting for higher demand and rates, to look for buyers elsewhere. Four LNG cargoes bound for Europe changed course to Asia since Oct. 20, according to energy intelligence company Kpler.

Read more: As European Gas Prices Fall, LNG Tankers Head off to Asia

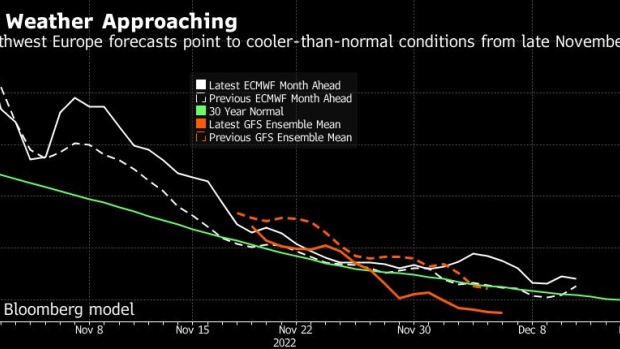

That may spur prices again, when it inevitably gets colder and fuel consumption jumps. The weather remains mild for now, but temperatures are already falling closer to seasonal norms in parts of the continent this week. Some forecasts also point to colder-than-normal conditions early next month, meaning an increase in heating demand.

“We are getting closer to a turn in the weather,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “The best protection against winter shortages remains a high price.”

Dutch front-month gas, Europe’s benchmark, steadied at €125.45 per megawatt-hour after gaining 8.3% a day before. The UK equivalent contract rose for a second day, adding 2% to 311.42 pence a therm. Benchmark German year-ahead power edged lower, reversing an earlier gain.

Traders see some demand for spot LNG cargoes from North Asian buyers from January onward if freezing weather lifts consumption. China’s weather agency forecasts temperatures mainly close or even higher than historic norms in the coming months, although some northern parts of the country could see cold snaps.

‘Alarm Bell’

“The cushion provided by the current mild temperatures, lower gas prices and high storage levels should not lead to overly optimistic predictions about the future,” the International Energy Agency warned Thursday.

Europe’s gas demand will decline by about 11% this year, but more is needed to avoid supply shortages in 2023, IEA Executive Director Fatih Birol said Thursday. “I am going to meet several European governments, communicate our results, in order to provide an alarm bell for next winter.”

Read also: Europe’s Imperfect Options for Transforming Its Energy Markets

Politicians in the European Union are already discussing further steps to tackle the crisis. Czech Republic, which holds the rotating Presidency of the EU, has drawn up its first compromise text on proposals for joint gas purchases and the region’s LNG benchmark, according to a document seen by Bloomberg.

Still, elements concerning a dynamic price cap on the region’s Dutch Title Transfer Facility were left untouched due to the “political sensitivity” of the issue ahead of a seminar planned for Nov. 7, the document said.

--With assistance from Anna Shiryaevskaya and Josefine Fokuhl.

©2022 Bloomberg L.P.