Nov 22, 2022

European Gas Rises as Gazprom Warns of Ukraine Transit Cut

, Bloomberg News

(Bloomberg) -- European natural gas advanced as the European Commission proposed an emergency brake on prices way above current levels just as Russia threatened to further cut flows sent through Ukraine.

Benchmark futures settled 3% higher after jumping as much as 7.6% earlier as the commission proposed a price-cap level of €275 per megawatt-hour. That’s more than double the present cost, but below the highs the continent suffered in the summer.

The announcement came shortly after Gazprom PJSC said its supplies via Ukraine may be reduced starting next week because some of the Russian fuel meant for Moldova remains in the transit nation.

Read more: Gazprom Threatens to Reduce Gas Flows to Europe Via Ukraine

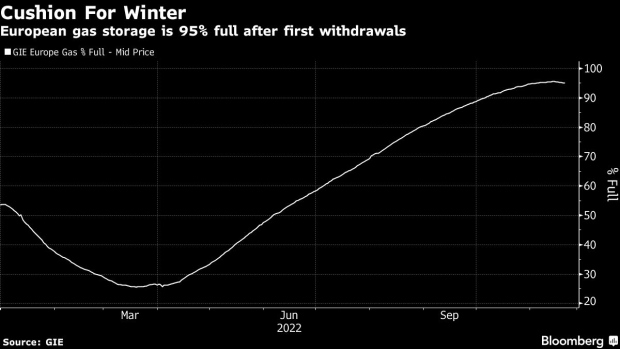

While just a few months ago Russia’s supply cuts caused far more dramatic price moves, the new threat comes as temperatures in Europe are set to dip below seasonal norms at the turn of the month, and net withdrawals from storage sites are picking up.

Europe is now in a relatively comfortable position as strong imports of liquefied natural gas and reduced industrial demand have helped counter months of Moscow’s supply curtailments. But even with fuller-than-normal inventories providing some buffer, winter without any Russian gas would be a challenge for Europe.

Gazprom said that Ukraine “accumulated” some gas meant for Moldova, and it will limit transit volumes from Nov. 28 corresponding to the amount of fuel not reaching Moldovan customers -- if the “imbalance” continues. While that’s just a fraction of what Ukraine ships from Russia to the European Union, there’s no guarantee the tensions won’t impact the broader European market.

Ukraine denied any breach, saying that it organized virtual reverse gas flows with Moldova. That means that some Russian gas volumes meant for Chisinau may stay in Ukraine, including for storage purposes.

Dutch front-month futures, Europe’s gas benchmark, closed at €119.64 a megawatt-hour. The UK equivalent rose 2%.

Protecting Markets

Gas rates are almost four times higher than usual for this time of the year, forcing governments to act and protect their economies.

The new price mechanism, proposed by the European Commission, would be triggered automatically when the benchmark does not reflect market fundamentals, Kadri Simson, the commission’s energy chief, said Tuesday. If security of supply, market stability or gas demand reduction requirements are at risk, it will be deactivated, she said. That addresses concerns in the industry that price caps can discourage supply away from Europe.

The price-cap plan is set to be discussed first by energy ministers at their emergency meeting on Thursday. National governments have the right to propose amendments to the regulation.

Separately, German officials said on Tuesday that they will introduce a cap on gas and electricity prices for companies and households next year.

--With assistance from Ewa Krukowska.

©2022 Bloomberg L.P.