Jun 30, 2022

European Gas Set for Monthly Spike as Russian Cuts Haunt Market

, Bloomberg News

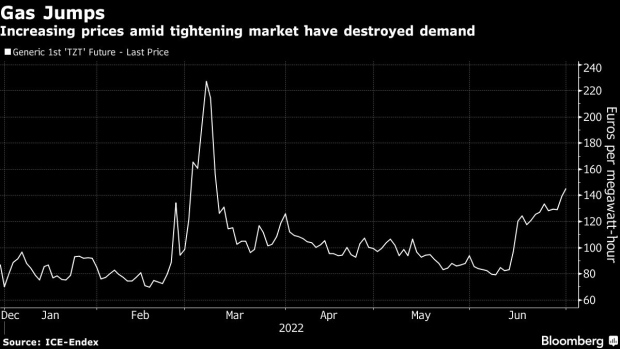

(Bloomberg) -- European gas is heading for the biggest monthly gain since September as Russia’s supply cuts put companies under stress and force governments to confront the prospect of major shortages.

Benchmark futures rose as much as 4% on Thursday, taking the month’s increase to more than 50%. The deep cuts earlier this month have rapidly tightened the market, overshadowing reduced summer demand and strong imports of liquefied natural gas. Countries are prioritizing refilling of storages in time for winter and urging consumers to reduce demand.

The impact of the cuts is spreading through the economy, crimping growth and hitting operations of companies. German energy giant Uniper SE is discussing a possible bailout from the government as Gazprom PJSC has been delivering only about 40% of contracted volumes since mid-June, forcing the utility to buy more expensive fuel in the spot market.

The European Union might be forced to take additional measures to destroy demand if Russia further cuts supplies in retaliation for sanctions related to the war in Ukraine. A planned maintenance shutdown at the Nord Stream pipeline -- the biggest link to the EU -- will halt flows for about 10 days next month, which many fear won’t resume.

The drop in demand from industries spiked this month, according to BloombergNEF. While that helps will freeing up gas to be sent into storage sites, it also exacerbates an economic slowdown in the region.

Dutch gas for August, the European benchmark, was 2.3% higher at 143.42 euros per megawatt-hour as of 9:14 a.m. in Amsterdam. The UK equivalent gained 2.3%.

©2022 Bloomberg L.P.