May 13, 2022

European Gas Steady With Traders Weighing Russia’s Next Move

, Bloomberg News

(Bloomberg) -- Natural gas prices in Europe held steady after a rally caused by disruptions at a key transit route through Ukraine and retaliatory action by Moscow that curbed supplies to Germany.

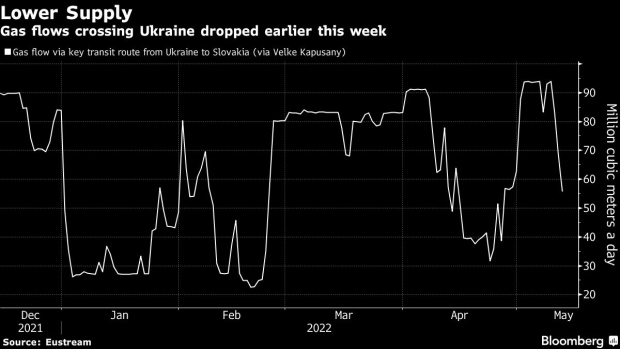

Benchmark futures were headed for a third weekly gain. Russian shipments through Ukraine have dropped this week, but may remain broadly stable on Friday -- near the lowest since late April -- based on data published by the Ukrainian gas grid late on Thursday and a statement from Gazprom PJSC on Friday.

Developments of the past three days wreaked havoc on the European energy market after a period of relative calm brought by warm weather and a steady supplies of liquefied natural gas. On Wednesday, gas shipments to Europe via Ukraine were curtailed after a key cross-border entry point was put out of action because of troop activity on the ground. Moscow then issued counter-sanctions in retaliation for Europe’s penalties over the war in Ukraine, which curbed supplies to countries like Germany.

Moscow’s restrictions on a group of gas companies seized from its control by Germany also threaten to disrupt the global LNG market, upending a significant supplier Gazprom Marketing & Trading Ltd. In addition, the sanctions targeted a pipeline that crosses Poland, removing a potential backup route for European customers to receive Russian gas.

All of these come just as payment deadlines for key European buyers become due this month under the new gas-for-rubles regime. This has been the biggest headache for the market in recent weeks, with Poland and Bulgaria cut off for failing to meet new payment demands. But a solution for others appeared to be emerging.

Companies including German giant Uniper SE were increasingly confident they could keep buying Russian supplies without breaching sanctions. Italy’s Eni SpA hasn’t set up a ruble account yet, people familiar with the matter said, but the company is doing the legal work in preparation of setting one up if needed.

Can Cope

Dutch front-month gas, the European benchmark, was 0.1% lower at 106.58 euros per megawatt-hour as of 9:04 a.m. in Amsterdam. It’s up 3.1% for the week.

Both Poland and Germany said they can cope with the latest disruption in part by securing alternatives. Yet, this week’s events revived fears of a supply crunch next winter. While many European countries are ready to cut gas consumption this year, part of their plan to reduce reliance on Russia’s fuel, alternatives may come at a cost given increased competition.

“The silver lining here is that EU buyers are not caught completely off guard,” Rystad Energy’s senior analyst Kaushal Ramesh said in a note. “But the outlook for winter 2022 supply is now a lot more pessimistic.”

©2022 Bloomberg L.P.