Dec 21, 2021

European gas jumps to record as Russian flows reverse direction

, Bloomberg News

Oil, gas, and renewable energy stocks are outperforming the most: Ryan Bushell

European gas prices jumped to a record high after Russian flows via a key route reversed direction.

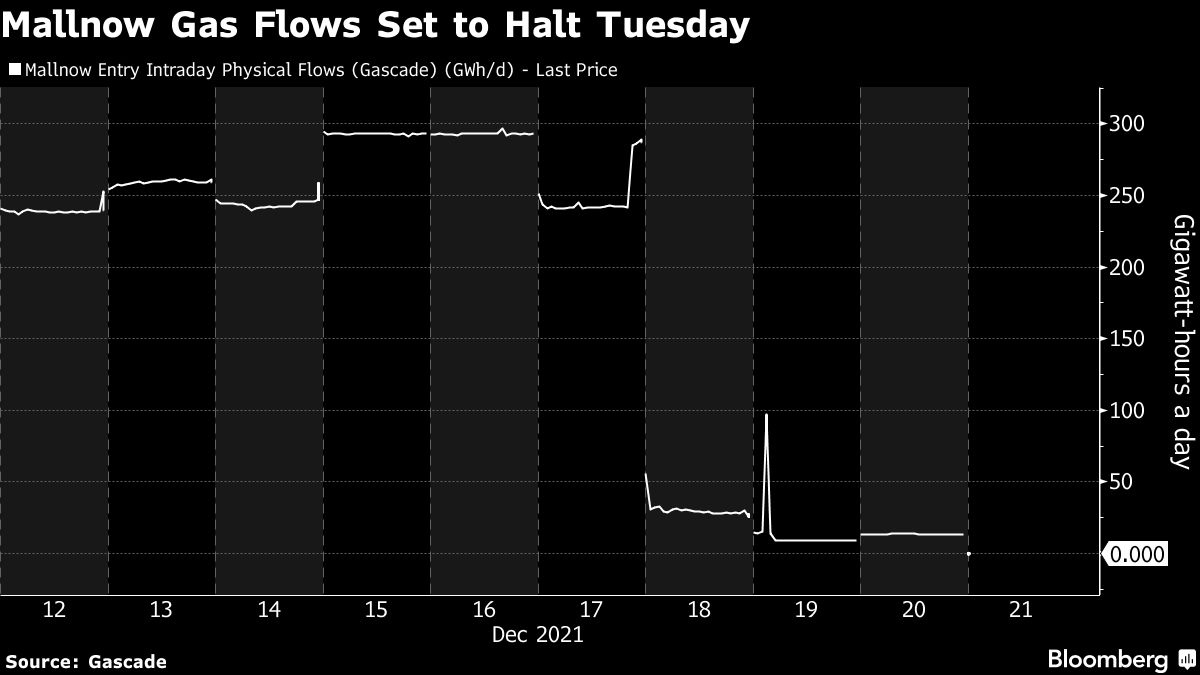

Futures surged as much as 11 per cent as Russian gas was flowing eastward from Germany to Poland, according to network operator Gascade. The change in flows probably reflects lower orders from German buyers due to the holiday season, said Katja Yafimava, a senior research fellow at the Oxford Institute for Energy Studies.

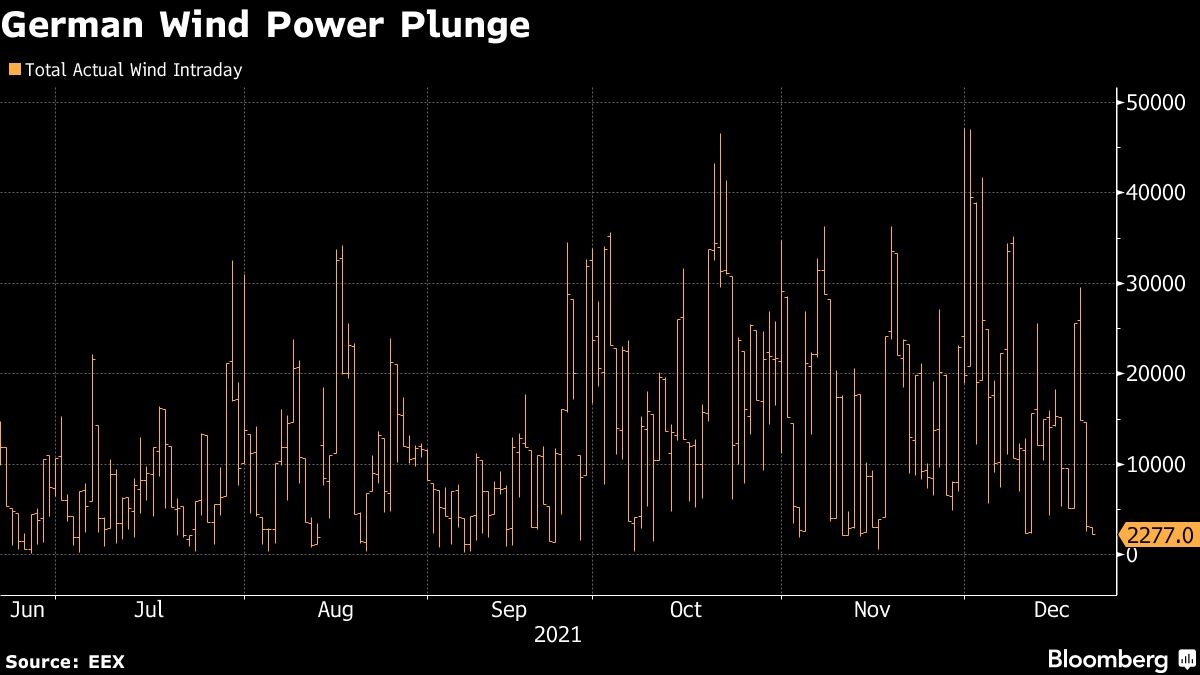

Lower supplies into Germany will force Europe to keep withdrawing gas at high rates from its already depleted storages. As freezing temperatures spread across the continent this week, more gas will be needed to keep the lights on as Europe’s vast network of renewable sources also can’t fill the gap, with German wind output at the lowest in five weeks.

“These exciting times will continue for a bit longer and will probably not end before the winter ends,” said Hans van Cleef, a senior energy economist at ABN Amro. “Depending on how much inventories will be left by then, the price effects of current shortages could last even much longer.”

Analysts expect gas stockpiles to end the season at a record low, potentially extending Europe’s energy crunch into next winter, a headache for policy makers already contending with rising inflation. Tensions between Russia and Ukraine are also leaving the market on edge, with fear of an invasion early next year.

FUTURES JUMP

Benchmark European gas prices traded in the Netherlands surged to an all-time high of 162.78 euros a megawatt-hour. Futures were up 9.4 per cent at 160.75 euros by 11:23 a.m. in Amsterdam.

Russian gas flows into the Mallnow compressor station, where the Yamal-Europe pipeline terminates, dropped to zero and the link was instead flowing eastward to Poland. The change in the normal direction was already in the cards after no capacity to flow gas into Mallnow on Tuesday was booked in various auctions.

“Gazprom simply didn’t need capacity at Mallnow today to meet its existing contractual obligations,” Yafimava said. “I think we won’t see significant daily bookings on Yamal throughout the Christmas period but there will be a limited uptick in January.”

Gazprom PJSC has been flowing less gas to Europe as the Russian gas giant pushes for approval of its controversial Nord Stream 2 pipeline. Limited supplies have forced Europe to rely on its depleted gas storages and burn more coal, the dirtiest of fossil fuels, to keep the lights on.

“We have no idea if it’s because of Gazprom having no spare production in front of record Russian demand or a hidden political agenda,” said Thierry Bros, a former energy trader who’s now a professor at the Paris Institute of Political Studies.

Freezing weather this week is also sending short-term power prices surging as renewables can’t keep up. German wind output plunged to as low as 2,277 megawatts on Tuesday, the lowest since Nov. 16.

Day-ahead German power traded in the over-the-counter market climbed to 420 euros a megawatt-hour, broker data showed.

There’s some relief in sight for Europe as the cold weather may not last.

“It looks like this week could be the peak cold/demand for Europe for the next several weeks,” said William Henneberg, a meteorologist with the Commodity Weather Group. “Again, that is a tenuous statement but that has been at least the trend since last week.”