Feb 25, 2022

European Natural Gas Halts Rally as Flows From Russia Ramp Up

, Bloomberg News

(Bloomberg) -- European natural gas prices halted a record-breaking rally, as Russian flows to the continent ramped up and U.S. sanctions targeting Moscow omitted the energy sector.

Benchmark futures fell as much as 21%, after four consecutive days of gains. On Thursday, prices rose more than 60%, the most since at least 2005, amid uncertainty on how the conflict in Ukraine would impact flows from Europe’s biggest supplier.

Utilities are ordering more of the fuel under long-term contracts with Gazprom PJSC after prices rallied as Russia began a full-scale invasion. That’s because the deals are priced in such a way that Russian imports are now cheaper than spot gas traded at European hubs.

Flows are rising on the back of an intensified Russian invasion into Ukraine. Ukraine’s foreign minister said Kyiv was hit with “horrific” rocket strikes as Russian troops pushed closer to the capital. The U.S. and U.K. unveiled a fresh round of sanctions aimed at crippling Russia’s economically for its attack on Ukraine, the worst security crisis in Europe since the end of World War II.

However, the Biden administration defended its decision not to sanction Russia’s energy sector, with an official saying it was reluctant to disrupt an area “where Russia has systemic importance in the global economy.”

“We’re not going to do anything which causes an unintended disruption to the flow of energy as a global economic recovery is still underway,” Deputy National Security Advisor Daleep Singh told reporters at the White House.

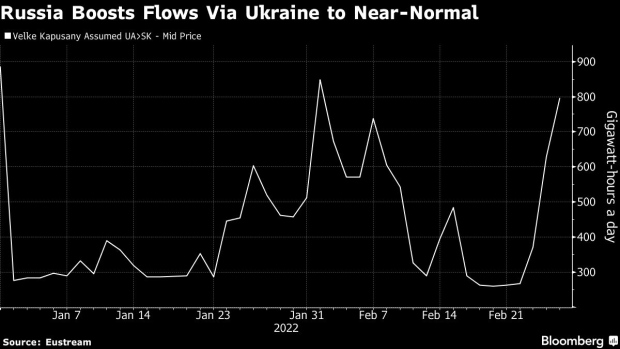

Russian gas exports through Ukraine jumped almost 38% on Thursday and are expected to increase by about 24% on Friday, according to data from Ukraine’s grid operator. Gazprom has reiterated that gas transit via Ukraine is running as normal.

“We believe that the risk of curtailment of Russian gas deliveries below its contractual commitment is limited unless there is a further material escalation of the crisis,” JPMorgan Chased & Co. analysts Vincent Ayral and Javier Garrido, said in a report.

Dutch gas futures, the European benchmark, traded 18% lower at 110 euros a megawatt-hour by 8:31 a.m. in Amsterdam.

Trade Finance

The conflict is showing the first signs of stifling trade in vital raw materials, as the money that lubricates the flow of everything from crude oil to wheat is beginning to dry up.

Some European banks have begun to impose restrictions on commodity-trade finance linked to Russia and Ukraine, heaping pressure on traders who were already looking for additional credit and bracing for harsh western sanctions on Moscow.

Europe is already in the midst of an energy supply crunch due to low inventories of natural gas, and the conflict in Ukraine has highlighted the continent’s vulnerability to a disruption in fuel flows. More than a third of Europe’s gas supply comes from Russia, and typically a third of that volume transits via Ukraine.

“Europe is already facing a big headwind from its energy bill,” analysts from Citigroup Inc. said in an emailed note. “It is clear that the move in prices is going to quickly move to ration demand away from the marginal consumer; we suspect that we are not far off finding out who those marginal consumers are.”

©2022 Bloomberg L.P.