Mar 27, 2023

European Real Estate Stocks Could Fall by 50%, Citi Says

, Bloomberg News

(Bloomberg) -- European real estate stock prices could drop by half as the sector grapples with higher debt-servicing costs and a slump in property valuations, according to analysts at Citigroup Inc.

Aaron Guy and his Citi colleagues made the projection for share prices as they forecast a 20%-40% decline in asset values over 2023 and 2024. “Commercial real estate stocks are not pricing for historic cyclical troughs which we believe are relevant benchmarks,” they wrote in a note Monday.

Property companies are confronting a drop in demand as surging interest rates curtail applications for mortgages and the threat of a recession hinders rental income. The industry’s heavy debt load also leaves it directly vulnerable to policy tightening by central banks fighting inflation.

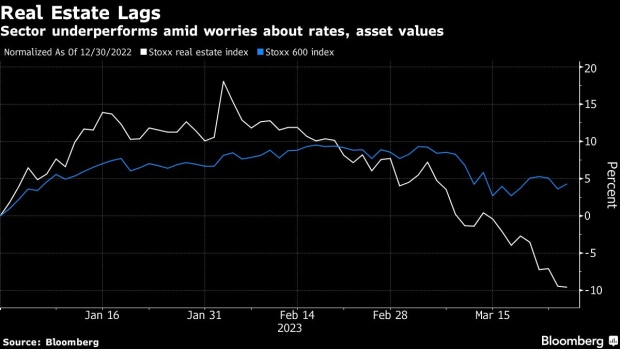

The Stoxx Real Estate Index has been among the worst-hit among European sectors since Silicon Valley Bank’s collapse fueled concerns about tighter lending conditions. The sector is down 15% this month, and trimmed the losses with a 1% gain today.

Rate moves from the second half of 2022 “are not priced into real estate values,” the Citi team wrote. Citi’s sell-rated real estate equities include office-focused Gecina SA and Inmobiliaria Colonial Socimi SA, as well as shopping center investor Klepierre SA. All three stocks have declined during the period that Citi has rated them sell.

But it’s not just the shares of real estate companies that are suffering, with property sector bonds also under strain. Over the past year, every real estate bond in the European investment grade corporate bond index has fallen, accounting for the six biggest percentage drops in the overall gauge, according to data compiled by Bloomberg.

On Monday, bond prices for 15 of the 19 real estate companies in the index were lower, with Akelius Residential AB, Heimstaden AB and Castellum AB leading losses.

“Listed bond yields for real estate have significantly increased and in some cases reached levels that create long-term instability in business models,” the Citi analysts added.

--With assistance from Ronan Martin and Sam Unsted.

(Adds bond market moves from fifth paragraph.)

©2023 Bloomberg L.P.