Nov 25, 2021

European Stocks’ Bull Market Set to Extend in 2022, SocGen Says

, Bloomberg News

(Bloomberg) --

European equities are set to extend this year’s rally in 2022, according to Societe Generale SA strategists, adding to optimistic voices that expect stocks to brush off risks and keep rising.

“We think the bull has plenty to feed on,” strategists including Roland Kaloyan wrote in their annual outlook note, citing peaking cost inflation, European Central Bank policy desynchronizing from the Federal Reserve, and the region’s equities trading at historic lows versus U.S. peers.

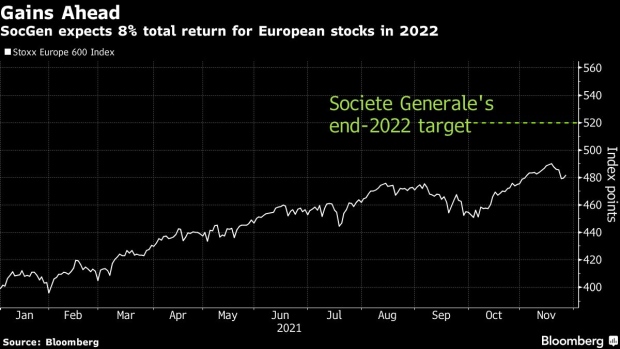

SocGen sees the Stoxx 600 Index ending 2022 at 520, implying more than 8% upside versus Wednesday’s close. Still, that’s below Goldman Sachs Group Inc.’s forecast of 530 and would represent something of a slowdown after the benchmark gained 21% in the year-to-date.

A basket of stocks that stand to benefit from the European Commission’s Green Deal is SocGen’s core investment recommendation for 2022, with several factors including the German coalition being potential catalysts.

The strategists also recommend going long on banks and firms with rising capital expenditure and buybacks, and short on auto stocks. Their overall positioning tilts toward cyclicals over defensives as the economy recovers.

©2021 Bloomberg L.P.