May 16, 2022

European Stocks Drop as China Slowdown Woes Fuel Growth Concerns

, Bloomberg News

(Bloomberg) -- European stocks started the week with small declines as weaker-than-expected economic data in China fueled investor concerns about a negative impact on global growth.

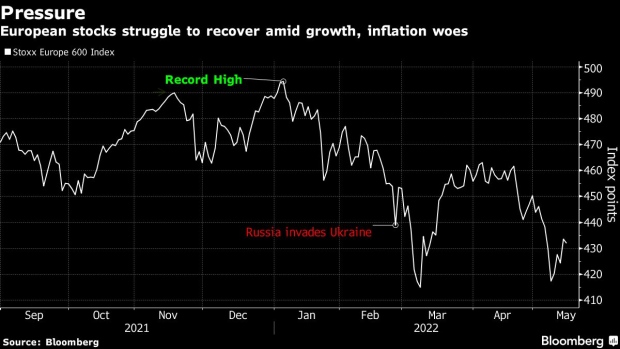

The Stoxx Europe 600 Index was down 0.5% at 8:02 a.m. in London after a rally on Friday helped the index snap a four-week losing streak. Personal care and travel and leisure sectors were among the biggest decliners, while telecoms outperformed.

READ: Cooling Valuations Create a Few Pockets of Value: Taking Stock

The European gauge has been under pressure this year even as corporate profits have held up, with investors fleeing risk assets on worries about hawkish central banks, surging inflation and a potential recession. Latest data from China showed industrial output and consumer spending hit the worst levels since the pandemic began.

“The path for rate expectations and inflation probably matter more than earnings for stock market performance,” Goldman Sachs Group Inc. strategists led by Lilia Peytavin wrote in a note. The strategists raised their expectation for European profit growth in 2022 to 7% from 2%, but warned of a “significant” hit to the economy from the war in Ukraine.

Russel Matthews, senior portfolio manager at Bluebay Asset Management LLP, also said the slowdown in growth will remain “one of the most challenging aspects in Europe.”

“I do think there is an over-estimation of what the European Central Bank can do in the face of the uncertainty coming from China,” he said in an interview with Bloomberg TV.

Over at JPMorgan Chase & Co., strategists in a note said that European equities stand to recover from here, as “peak Fed hawkishness is starting to get traction.” Inflation is showing a turn lower for the first time in a while, suggesting the Federal Reserve might not be significantly behind the curve anymore, the strategists said.

- For a daily wrap highlighting the biggest movers among EMEA stocks, click here

- You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance.

©2022 Bloomberg L.P.