Feb 26, 2020

European Stocks Drop With Travel Shares on Spreading Virus Woes

, Bloomberg News

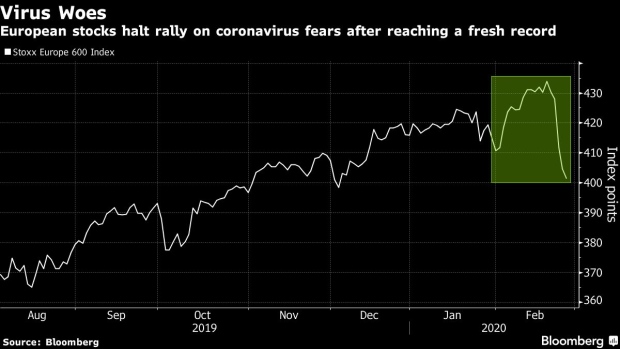

(Bloomberg) -- European equities fell as the coronavirus continued to affect countries across the globe and American health officials warned that they expect the epidemic to spread in the U.S., fueling a shift from risk assets to defensive strategies.

The Stoxx Europe 600 Index declined 0.8%, led by travel shares. Luxury stocks also continued to drop, with LVMH Moet Hennessy Louis Vuitton SE retreating 1%. The FTSE 100 Index declined below the level of 7,000, dipping to the lowest point in more than a year.

European equities started this week with the worst two-day drop since the Brexit aftermath in June 2016 amid increasing concerns that the spreading virus will curb global growth and impact corporate earnings and supply chains. South Korea, Asia’s fourth-largest economy, said its national total for coronavirus cases is now more than 1,000, up from just 51 a week ago. European stocks are coming down from a record high reached last week as some investors mull whether the rally has gone too far.

“The ‘buy the dip’ culture is fading as investors realize that it is possibly just a matter of time before an outbreak will happen in another large western country or city,” said Alberto Tocchio, chief investment officer at Colombo Wealth SA in Lugano, Switzerland. “We cannot rule out further downside if the virus continues to spread across the world as predicted by many experts.”

To contact the reporter on this story: Ksenia Galouchko in London at kgalouchko1@bloomberg.net

To contact the editors responsible for this story: Blaise Robinson at brobinson58@bloomberg.net, Jon Menon

©2020 Bloomberg L.P.