Jan 31, 2023

European Stocks Trim Best Start of Year Since 2015 Ahead of ECB

, Bloomberg News

(Bloomberg) -- European stocks declined on Tuesday, trimming one of the best starts to the year ever, as investors braced for expected interest rate hikes from central banks in the coming days, while also digesting earnings from large lenders.

The Stoxx Europe 600 Index closed down 0.3% after falling as much as 1% earlier. On a busy day for bank results, Switzerland’s UBS Group AG retreated after weakness in its equities and wealth-management sales.

However, Italy’s UniCredit SpA soared 12%, the most in more than two years, after better-than-expected profit and shareholder returns, driven by higher interest rates. Swedbank AB also gained after after a jump in net interest income.

Real estate shares slipped, as did miners amid declines for base metals. Drinks makers rose, with Diageo Plc getting an upgrade at Investec following last week’s slump on weak earnings. Automakers also outperformed.

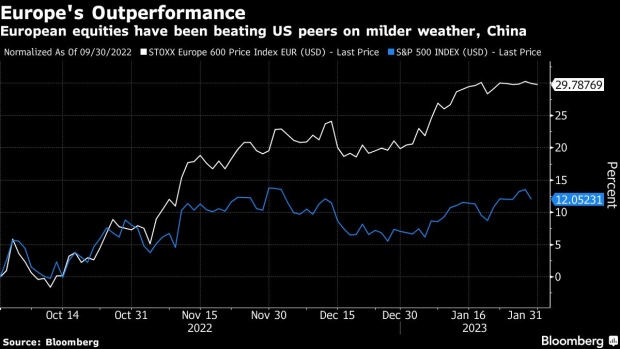

Investors have been taking profit on one of the sharpest early-year rallies for European equities, during which the region has strongly outperformed US peers. The Stoxx 600 Index has still risen about 7% this month, the biggest January gain since 2015, on hopes of easing inflation and declining gas prices, as well as China’s economic reopening. The Euro Stoxx 50 gauge has gained about 10% in January, the best debut to a year on record.

Money managers are now looking ahead to policy decisions from the European Central Bank, Bank of England and Federal Reserve, as rate setters push on with efforts to tame inflation. Data yesterday showed Spanish inflation unexpectedly quickened in January, ahead of the ECB’s update.

Meanwhile, statistics Tuesday showed the euro-area economy unexpectedly grew in the fourth quarter, with France — the euro zone’s No. 2 economy — avoiding contraction.

That’s after data Monday revealed a downturn in Germany in the final three months of the year. Still, some investors fear significant earnings downgrades could follow as a recession takes hold.

“We do think consensus numbers are lagging behind,” said Sutanya Chedda, a European equities strategist at UBS, adding that she’s already seeing signs of weakening profit margins. “We expect that to be a dominant theme, as companies move from having that pricing power to seeing some demand weakness,” Chedda added by phone.

According to Citigroup Inc. strategists, Euro Stoxx 50 positioning is now the most extended bullish since mid-2021, but momentum has slowed drastically in the second half of January.

--With assistance from Ksenia Galouchko.

©2023 Bloomberg L.P.