May 30, 2020

Europeans Not Feeling Very Hopeful About Their Economy Just Yet

, Bloomberg News

(Bloomberg) -- Europe is mostly open for business again after months of lockdown. Green shoots are emerging from the economic rubble, with indicators of activity and confidence inching up.

Yet a closer look at the European Commission’s sentiment survey for May shows companies and people are glum about the economy, suggesting any recovery will be drawn out and slow.

People are finally able to leave their homes for more than just grocery shopping, but many don’t feel it’s time for major purchases of things like furniture or electrical goods. Savings figures suggest there’s pent-up demand, but right now big spending doesn’t look like it’s a priority.

That’s fueling concern among economists that the lockdown may have caused a shock to consumption that could inflict long-term economic damage.

It’s no surprise people are shy about purchases with jobless claims rising and companies saying they won’t be hiring for now. When you add to that the many firms that will only reopen partly due to social distancing rules -- or even not at all -- the job market looks grim.

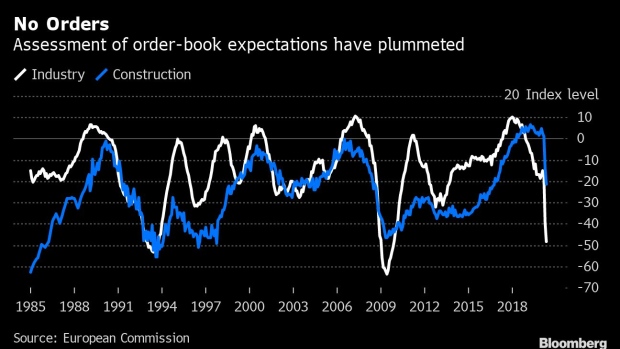

Construction and manufacturing are particularly downbeat: As shuttered factories try to return to normal, they face meager order books which could further impact employment and consumption.

Selling abroad isn’t much of an option either as closed or semi-closed borders and persistent fears about a second wave of the virus leave industry managers deeply pessimistic about exports.

With demand in question, companies aren’t that optimistic about raising prices. Selling price expectations remain very muted across sectors and economies. If that hits company profits, that’s another threat to jobs.

Governments are trying to dispel some of these fears and support their economies with massive spending programs. The European Union this week unveiled an unprecedented 750 billion-euro ($825 billion) stimulus proposal, and individual nations are also funneling money into support. That will be followed by stimulus in many countries as governments try to revive economies after keeping them afloat over the past two months.

©2020 Bloomberg L.P.