Sep 19, 2022

Even State-Backed China Developers at Risk of Surging Default, Citi Says

, Bloomberg News

(Bloomberg) -- Financial contagion has spread so far across China’s property industry that even state-backed developers are at risk of surging default, according to Citigroup Inc. analysts.

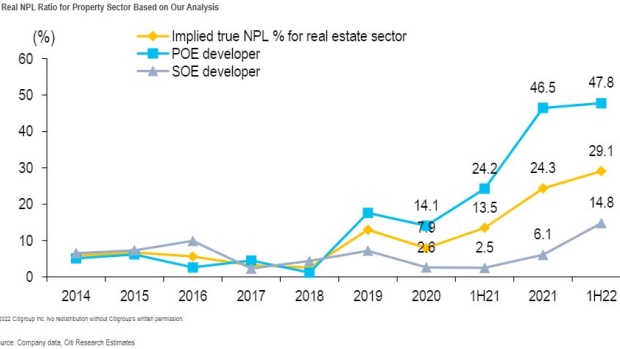

Bad debt climbed to about 29.1% of total property loans in the first half of this year, up from 24.3% at the end of 2021, according to calculations by Citi’s team including Judy Zhang. The increase is largely attributable to developers controlled by the Chinese government, the analysis showed.

“There is a spillover effect from POE developer defaults, leaving even some SOE developers with financing difficulties and heightened debt default risk,” the analysts wrote in a Sept. 14 note.

China’s $52 trillion banking industry is dealing with an increasing number of soured loans as the property crisis and sporadic Covid Zero lockdowns hammer business confidence. Chinese lenders’ exposure to real estate is bigger than that of any other industry at 53 trillion yuan ($7.6 trillion). A mortgage boycott that escalated earlier this year could leave banks with losses of as much as $350 billion in a worst-case scenario, according to forecasts by S&P Global Ratings.

Major banks including Industrial & Commercial Bank of China Ltd. and Agricultural Bank of China Ltd. reported higher non-performing loan ratios for the real estate sector in their latest earnings reports. With lenders already setting aside provisions or writting off bad debts, Citi says investors may be “over-penalizing” banks and pricing in a worse-than-expected deterioration in asset quality.

“We think the overall systematic risk is manageable,” the analysts said. Shares of Chinese banks are trading at about 2.1 times their estimated price to pre-provision earnings in Hong Kong, compared with 5.9 times for global banks.

For all industries, Citi estimates real non-performing loans are more than five times the reported figure at 9.5%, up from 8% in 2021. The transportation industry was the biggest driver of the increase, followed by property.

©2022 Bloomberg L.P.