(Bloomberg) -- China Evergrande Group is facing a crisis of confidence among creditors who’ve lent the world’s most indebted developer more than $120 billion.

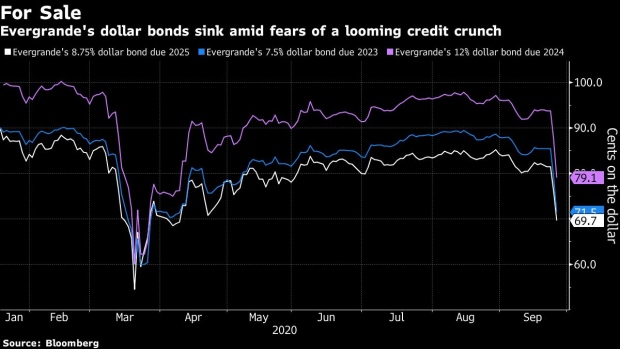

Long-simmering doubts about the health of China’s biggest property company by revenue exploded to the fore on Thursday, following reports it had warned local government officials of a potential cash crunch that could threaten China’s financial stability. Investors dumped Evergrande’s bonds, sending its yuan note due 2023 down as much as 28% on Friday to a record low. High-yield dollar debt slumped across Asia.

Evergrande said in a statement that rumors and documents circulating online were “fabricated” and “pure defamation,” without commenting directly on whether it had warned officials of a potential cash crunch. The developer, controlled by billionaire Hui Ka Yan, said it generated 400 billion yuan from project sales in the first eight months and maintains healthy operations. Evergrande won approval from Hong Kong’s stock exchange to spin off its property management unit, a person familiar with the matter said on Friday, paving the way for it to raise additional capital.

Worries that Evergrande may still face a liquidity shortfall stem from an agreement with some of its biggest strategic investors. It gives them the right to demand their money back if the company fails to win approval for a backdoor listing on the Shenzhen stock exchange by Jan. 31. The repayment could amount to 130 billion yuan ($19 billion), or about 92% of Evergrande’s cash and cash equivalents. At least one of those investors has signaled it would be unwilling to extend the deadline.

In another sign that creditors are growing increasingly concerned, at least five Chinese banks and two trust firms held emergency meetings on Thursday night to discuss their Evergrande exposure and access to collateral, people familiar with the matter said. Among them was China Minsheng Banking Corp., whose exposure to Evergrande exceeds 29 billion yuan, one of the people said. That makes it the most exposed bank to the developer, based on the letter sent to Guangdong authorities.

At least two of the banks that convened meetings decided to bar Evergrande from drawing unused credit lines, according to people familiar. The developer had credit lines of 503 billion yuan as of June 30, of which 302 billion yuan were unused.

Minsheng Bank declined to comment. Calls to the media office of the Guangdong government on Thursday went unanswered.

“Regardless of the authenticity of the letter, we think the situation may have prolonged negative impact,” Manjesh Verma and Stella Li, credit analysts at Citigroup Inc., wrote in a report. “It increases concerns among various investors and lenders and hence increases difficulty in funding access and refinancing.”

Evergrande has long been viewed as a poster child for highly leveraged companies in China, where corporate debt swelled to a record 205% of gross domestic product in 2019 and has likely climbed further this year as firms increased borrowing to tide themselves over during the pandemic. Evergrande has tapped banks, shadow lenders and the bond market in recent years to expand far beyond the property industry into businesses ranging from electric cars to hospitals and theme parks –- areas that often align with Chinese President Xi Jinping’s policy priorities.

Though it’s unclear why Evergrande has yet to win approval for its listing plan, some analysts have speculated it may relate to China’s efforts to tame sky-high home prices and restrain fundraising by developers. Regulators have since 2016 been using a wide range of policy levers to ban speculative home-buyers, curb expensive land prices and restrict lending to residential builders.

While Evergrande has said it won’t raise new funds through the listing, its stake sale to strategic investors implies a valuation of about 425 billion yuan for the unit, which holds most of Evergrande’s real estate assets. That’s almost three times higher than the market value implied by the developer’s existing shares in Hong Kong. Chinese property developers trade at about 12 times projected earnings on average in Shanghai and Shenzhen, compared with about 5 times in Hong Kong.

Another unanswered question surrounding Evergrande is whether China’s government would step in to support the developer if it struggles to repay creditors. While policy makers have a long history of providing backstops for systemically important companies to maintain financial stability, the government has in recent years sought to instil more market discipline and reduce moral hazard.

As part of those efforts to rein in risk in the country’s $45 trillion financial system, authorities have taken control of indebted conglomerates including HNA Group Co., Anbang Insurance Group Co. and Tomorrow Group. Policy makers have also introduced new rules for financial holding companies, including Evergrande, that impose minimum capital requirements and other restrictions meant to reduce systemic risk.

S&P Global Inc. on Thursday downplayed the threat of a liquidity crunch for Evergrande. While the ratings company cut its outlook on the developer’s B+ credit rating to negative from stable, it noted that Evergrande is trying to convince strategic investors to stay put and is an “asset-rich” company with multiple fundraising channels. The developer’s sales will likely remain steady in 2020, S&P said.

Evergrande has vowed to increase sales as part of its efforts to meet an aggressive deleveraging target -- cutting borrowings by about 150 billion yuan each year from 2020 to 2022, or about half its current debt load.

The company has so far fallen short of the pledge. Total debt rose 4% to 835 billion yuan as of June 30, compared with 800 billion yuan at the end of 2019, according to its recent earnings report. Evergrande had 395.7 billion yuan of short-term debt as of June, almost triple the company’s cash, equivalents and short-term investments combined, data compiled by Bloomberg show.

Here are some of the biggest Evergrande-related market moves as of 1 p.m. Hong Kong time on Friday:

- Evergrande shares fell 3.8% in a volatile session; China Evergrande New Energy Vehicle lost 12%

- Chinese Estates Holdings Ltd., which owns about 860 million Evergrande shares, slumped 6.3%

- Other property developers also sank; Sunac China Holdings fell 4.6%; Jinke Properties lost 3.5%

- Evergrande’s dollar notes are the five worst performers on a Bloomberg Barclays index of Asian dollar bonds; the company’s dollar bond due 2025 slumped 6.4 cents on the dollar to 69.7 cents, the lowest level since early April

- Some of Evergrande’s domestic bonds hit record lows with sharp declines temporarily triggering halts to trading; Its yuan bond due 2022 fell 13% to 82 yuan; bond due 2024 fell 31% to 65 yuan

©2020 Bloomberg L.P.