Feb 27, 2023

Evergrande Fails to Win Creditors’ Support as Key Dates Loom

, Bloomberg News

(Bloomberg) -- China Evergrande Group, the developer at the epicenter of the country’s real estate crisis, has yet to reach an agreement with major creditors on a debt restructuring framework crucial to avoiding potential court-ordered asset liquidation, people familiar with the matter said.

There is still no deal with an ad-hoc group of dollar-bondholders, according to the people, who asked not to be identified speaking about a private matter. The clock is ticking. Evergrande has said it wanted to get support from the noteholders by early March and it faces a March 20 court hearing in Hong Kong on a winding-up petition.

Evergrande didn’t comment when asked about the status of the talks. Advisers to the ad-hoc group, Moelis & Co. and Kirkland & Ellis LLP, declined to comment.

Evergrande’s debt restructuring is one of China’s largest ever and carries broader implications for the country’s nearly $60 trillion financial system. The progress of debt-restructuring plans is a crucial factor in a winding-up petition filed last June against the company. In such cases, a borrower’s assets can be liquidated to fund creditor repayment.

Judge Linda Chan urged Evergrande at a November hearing to offer up “something more concrete” at the March court appearance that’s now less than three weeks away.

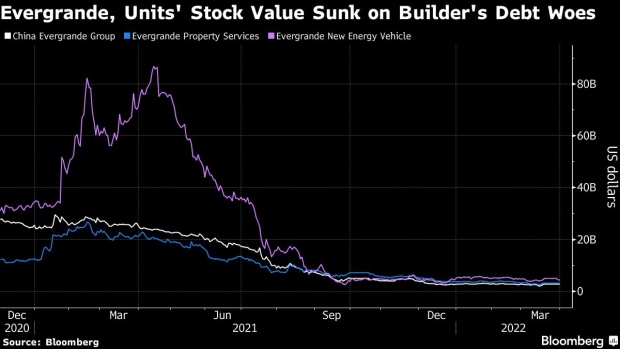

The main disputes between the world’s most indebted builder and the ad-hoc bondholder group include the equity value of Evergrande and its two Hong Kong-listed units, the people said.

The bondholders have asked for Evergrande’s entire stake in its electric-vehicle and property-management arms, but the company has offered less than that, according to other people familiar with the matter. Evergrande owns about half of the property-management unit and nearly 60% of the auto business, according to data compiled by Bloomberg.

Another key area of disagreement between Evergrande and the ad-hoc group involves the structural seniority of Evergrande’s debt, according to the first group of people familiar with the matter. The issue affects different creditors’ rights to its assets, and a particular point of contention is the claims of certain onshore creditors, the people said. The bondholders are also demanding Evergrande address corporate-governance issues, they added.

Evergrande defaulted for the first time on dollar bonds at the end of 2021, and has missed several self-imposed timelines to release a restructuring plan.

One shift in the ad-hoc bondholders’ requests is that the group is no longer seeking Evergrande Chairman Hui Ka Yan to inject at least $2 billion into the firm as a condition for agreeing with any debt proposals from the company, the people said. They added the investors are still seeking some capital from him.

The liquidity crunch that affected Evergrande and many peers fueled a record amount of dollar-bond defaults last year. Such woes have crimped the ability of lower-rated Chinese firms to sell offshore debt and prompted international investors to pull back from the country’s onshore bonds.

Bloomberg News reported in January that Evergrande had been discussing a debt-restructuring proposal that included an option for creditors to swap some debt into stock of the builder and the two units via the issuance of hybrid securities such as convertible bonds.

Shares of Evergrande and the units haven’t traded since last March, when the firms warned of delays in releasing audited results. Based on their last trading prices, the trio’s equity was worth a combined HK$81 billion ($10 billion).

--With assistance from Emma Dong.

©2023 Bloomberg L.P.