Michelin Guide Awards Its First Hotel Keys in the US

Eleven hotels earned the top three-key distinction, in a list that focused on major markets rather than being truly comprehensive.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Eleven hotels earned the top three-key distinction, in a list that focused on major markets rather than being truly comprehensive.

Blackstone Inc. and KKR & Co. mortgage real estate investment trusts are grappling with deteriorating office loans as higher interest rates and weak demand drive down property values.

Bank of Canada officials said monetary policy easing is expected to be “gradual,” as they debate the timing of a pivot to rate cuts.

Recovering risk appetite and tightening spreads in the commercial real estate market mean active managers have to work a little harder, according to DoubleLine Capital LP.

Iceland’s inflation eased to the slowest pace in more than two years, suggesting its central bank is more likely to begin reducing the western Europe’s highest interest rate in the coming months.

Sep 25, 2020

, Bloomberg News

(Bloomberg) -- China Evergrande Group won approval from the Hong Kong stock exchange to spin off its property management unit, according to a person familiar with the matter, paving the way for the company to raise much needed capital.

The unit, recently valued at $11 billion in a stake sale to strategic investors, is seeking to conduct an initial public offering, the person said, asking not to be named because the matter is private.

If Evergrande pulls off the listing, it could replenish the indebted developer’s finances. This comes at a time strategic investors have the right to demand the company pay them $19 billion in January if it can’t complete a targeted listing in China. The stock rebounded Friday after slumping to a four-month low yesterday after Bloomberg News reported the developer had sought government help to avoid a cash crunch.

Read more: Evergrande Warns of Looming Cash Crunch, Spooking Investors

Chinese property developers have been seizing on a market rally to list their service arms and raise money to pare debt. Hong Kong-listed Evergrande needs the exchange’s approval for the restructuring. The Shenzhen-based company didn’t immediately respond to email and text queries for comment. The Hong Kong stock exchange declined to comment in an emailed statement.

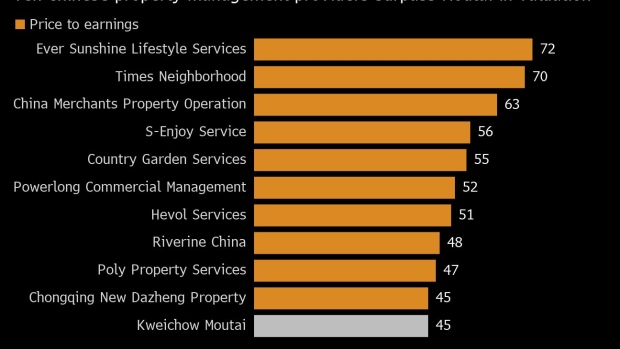

Unlike real estate assets that face government curbs and cyclical downturns, the property management units offer a stable business model with recurring fee revenue and low leverage. Investor demand has also prompted some of these companies to demand valuations loftier than Kweichow Moutai Co., the spirits maker that’s one of China’s most loved stocks.

Evergrande raised HK$23.5 billion ($3 billion) by selling a 28.1% stake in its property management arm to investors including Tencent Holdings Ltd. in August. Companies linked to Citic Capital Holdings, the wife of billionaire mogul Joseph Lau and the family investment arm of New World Development Co. billionaire Henry Cheng were among the cornerstone investors.

Other investors include Yunfeng Capital, the fund backed by Chinese e-commerce billionaire Jack Ma, and Sequoia Capital, people familiar said.

Read more: The Billionaire Club Behind China’s Most Indebted Developer

Evergrande has previously said it’s considering spinning off its property management business and listing it in Hong Hong.

The proceeds from the pre-IPO fundraising may allow Evergrande to reduce its net debt to equity, a key measure of leverage, to 153% from 159% at the end of last year, according to Bloomberg Intelligence.

©2020 Bloomberg L.P.